25 Great Sayings about Money (And Why We Love Them)

25 Great Sayings about Money (And Why We Love Them)

"Everybody wants money. That's why they call it money!" — David Mamet

At BudgetBakers, we think about money a lot. Not because we worship it, but because we understand its power—and its limitations. Money represents contradictory values: it's simultaneously essential and meaningless, liberating and constraining, a tool and a trap.

Here are 25 of our favorite money quotes, and why they resonate with us.

1. Ralph Waldo Emerson

"Money often costs too much."

Emerson understood that wealth and money aren't the same thing. Pursuing money can cost you time, relationships, health, and peace of mind. True financial success requires understanding that every dollar has a non-monetary price tag.

2. Steve Martin

Steve Martin once celebrated enjoying money while acknowledging the absurdity of some purchases. His humor reminds us that value is subjective—what seems ridiculous to one person might bring genuine joy to another. The key is being honest with yourself about what you're really buying.

3. William James

William James focused on legacy and contribution beyond material accumulation. He advocated for investing in institutions, ideas, and future generations rather than hoarding wealth. Your money can outlive you in meaningful ways—if you're intentional about it.

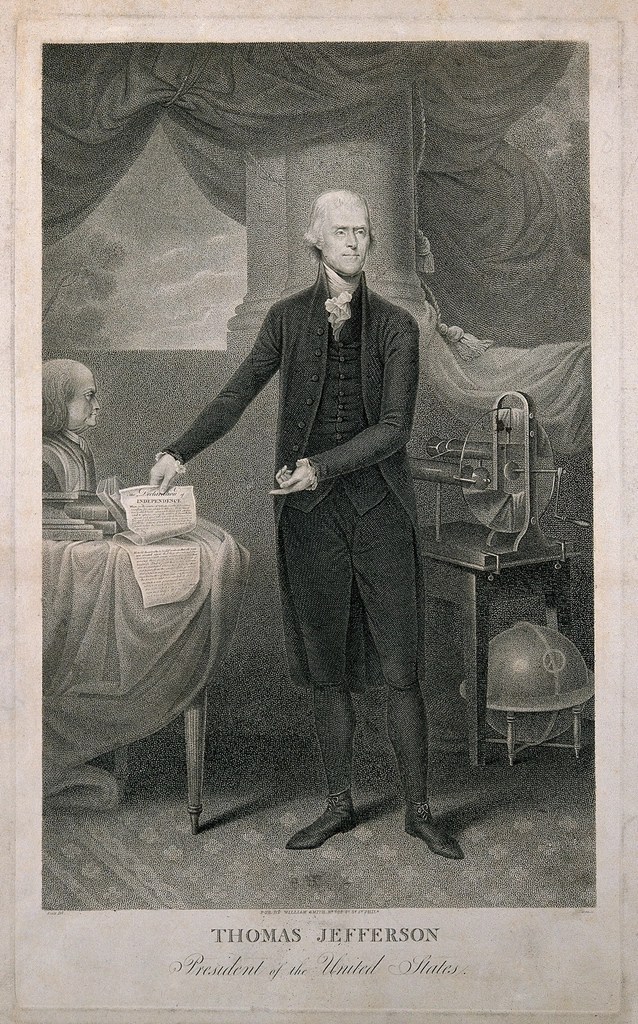

4. Thomas Jefferson

"Never spend your money before you have it."

Ironic advice from a man who died deeply in debt! But Jefferson's personal financial failures don't invalidate his wisdom. American spending culture makes it dangerously easy to spend money we haven't earned yet—credit cards, loans, buy-now-pay-later schemes. The simple act of waiting until you actually have the money is revolutionary.

5. Will Rogers

Will Rogers warned against lifestyle inflation and status-driven consumption. We're surrounded by messages telling us we need more, better, newer. But do we? Rogers encourages self-reflection about genuine needs versus manufactured desires.

6. Kin Hubbard

Hubbard promoted the simplest wealth-building strategy of all: avoiding unnecessary spending. It's not glamorous advice, but it's effective. You don't need a complex investment strategy if you're not hemorrhaging money on things you don't need.

7. A Father's Wisdom

Sometimes renting is smarter than owning. A wise father once explained that avoiding ownership expenses—maintenance, repairs, depreciation—can create actual savings. Not everything needs to be an investment; sometimes a simple transaction is the better deal.

8. Jamaican Proverb

"Save money and money will save you."

This proverb emphasizes emergency funds as protective mechanisms against unexpected hardship. When disaster strikes—job loss, medical emergency, car breakdown—your savings become a lifeline. Money saved isn't just money earned; it's security purchased.

9. Albert Einstein

Einstein (allegedly) called compound interest the eighth wonder of the world. The math is compelling: $50,000 invested at a reasonable return can grow to $550,000+ over a few decades. Time is the essential ingredient. The best time to start investing was yesterday; the second best time is today.

10. Marcelene Cox

Cox proposed that spending habits reveal character. How we spend money shows what we truly value, often more accurately than what we say we value. Financial tracking isn't just about budgeting—it's a tool for self-knowledge.

11. Warren Buffett

"The stock market is a device for transferring money from the impatient to the patient."

Buffett's first appearance on this list emphasizes patience as the antidote to rushed financial decisions. Get-rich-quick schemes enrich their creators, not their participants. Delayed gratification isn't sexy, but it works.

12. James W. Frick

"Don't tell me where your priorities are. Show me where you spend your money and I'll tell you what they are."

Actions supersede declarations. Your actual spending patterns indicate your true priorities more accurately than your stated values. If you say family is your priority but spend more on hobbies than on family activities, what does that reveal?

13. Spike Milligan

Milligan acknowledged that money can't solve existential unhappiness while improving material comfort. If you're fundamentally unhappy, more money won't fix it. But if your unhappiness stems from financial stress, addressing that stress helps. Know the difference.

14. Folk Saying

"It's expensive to be poor."

This folk wisdom explores poverty's financial inefficiency. Limited resources force repeated purchases of cheap items that break, late fees on bills you couldn't pay on time, and compounding debt. Poverty isn't just having less money—it's paying more for everything.

15. Thomas Fuller

"Debt is the worst poverty."

Fuller characterized debt as the ultimate constraint on freedom and future possibilities. When you're in debt, your future income is already spoken for. Every paycheck goes to paying for past decisions rather than building future opportunities.

16. H.L. Mencken

Mencken critiqued society's overvaluation of wealth. Money distorts reality and concentrates disproportionate influence among the wealthy. We listen to rich people's opinions on topics they know nothing about, simply because they're rich.

17. Norman Vincent Peale

Peale prioritized mindset and determination over initial circumstances. Your attitude matters more than your inheritance. People with nothing have built fortunes; people with everything have lost it all. The variable isn't starting capital—it's character.

18. Chinese Proverb

"With time and patience, the mulberry leaf becomes a silk gown."

This proverb celebrates persistent effort's compound results. Consistent daily work, like a silkworm spinning its cocoon, creates value that accumulates over generations. Family wealth is built slowly, through countless small efforts.

19. Henry Ford

Ford distinguished between temporary material security and enduring personal assets: knowledge, experience, and capability. Your car can be stolen; your skills cannot. Your savings can be lost; your ability to earn more cannot.

20. Chris Rock

"Wealth is not about having a lot of money; it's about having a lot of options."

Chris Rock reframes wealth as optionality rather than possessions. Financial health means freedom to choose your path—to quit a bad job, to take a risk, to help someone in need, to say no. That freedom is worth more than any specific purchase.

21. Warren Buffett (Again)

"Do not save what is left after spending, but spend what is left after saving."

Buffett's second appearance advocates "paying yourself first." This reverses typical spending patterns: instead of saving whatever's left over (usually nothing), you save first and then live on what remains. It's a simple reframing that changes everything.

22. Anonymous

"Money talks, but all mine ever says is 'Goodbye.'"

A humorous observation about money's transience without intentional management. If you're not tracking where your money goes, it's going somewhere—just not where you want it to.

23. Earl Wilson

Wilson underscored creditors' indifference to circumstances. Financial obligations demand compliance regardless of personal situations. Your landlord doesn't care about your bad week; your credit card company doesn't care about your emergency. Plan accordingly.

24. Peter Lynch

Lynch promoted purposeful ownership: every asset and dollar should serve an identified objective. Random accumulation isn't a strategy. What is each dollar for? If you can't answer that question, you're not managing your money—it's managing you.

25. David Mamet (Closing)

We return to where we started: "Everybody wants money. That's why they call it money!"

Mamet's observation is darkly funny because it's true. Money is universally desired precisely because it represents universal optionality. But wanting money and understanding money are different things.

These 25 quotes span centuries and cultures, yet they circle around common themes: spend intentionally, save consistently, avoid debt, think long-term, and remember that money is a tool, not a goal.

At BudgetBakers, we build tools to help you put these timeless principles into practice. Because wisdom is only useful if you act on it.