Learn 5 simple budgeting methods that’ll help you manage your money better!

Boring. Complicated. Restrictive. Mind-numbing. Cumbersome.

Are these the first words that come to your mind when your hear the word ‘budget’? Does your mind conjure up images of complex spreadsheets, continuous note-taking or repeated balance checks?

If you answered yes to one or both of these two questions, chances are that

A. You have never budgeted, or

B. You have budgeted and failed.

A budget is meant to simplify things for you. It should decrease the stress and anxiety that comes with not having control over your finances. It should put you in a better place. Feeling more in control, happier and calmer.

So, if your budget does none of this, then it is clearly not working for you. If your budget is only pumping up your anxiety levels, then we don’t blame you for abandoning it. And, if your budget only complicates things, then you might as well get rid of it, right?

But Wait…. Why Isn’t Your Budget Working?

For those of you who are exhausted by budgeting, we know it’s hard to convince you about its benefits. But have you really thought about why your budget didn’t work for you when it did just fine and sometimes even really good for someone else?

The answer to this is embedded right in that question. “It worked for someone else” is never a good reason to follow a particular budgeting method.

Just because a budget or a budgeting style works for a few people, it need not work for you.

Your budget should represent your goals and should cater to your preferences, not that of the ‘dude who saved 80% of his income, retired early and is now travelling the world’ or the ‘stay-at-home-mom who runs a blog and makes money while she sleeps’.

If you are not detail-oriented, then following the advice of someone who asks you to account for every cent you spend may not be the way to go. You are only setting yourself up for failure.

And, in case, you are at the other extreme and love to dig deep into your bank statements, then a budgeting method that asks you to save 20% and not care about how you spend the rest would put you in an uncomfortable space.

Likewise, someone with a bad memory may want to track their spending on the go rather than making a note of all their transactions together at the end of every week or month.

In short,

the budgeting method you pick should be simple and something that you know you would stick to.

Because, budgeting is not meant to be a pain. It should empower you.

So here you go…

5 Simple Ways To Budget And Stay In Control Of Your Finances

Here’s a list of the simplest five methods to budget (or not budget in some cases). You can use this as a starting point to figure out which (or what combination) of these methods listed below might work for you. Or, they could be an inspiration to even create your own method.

Envelope Budgeting or When You Put Away Money For Major Expenses

This is one of the most popular methods of budgeting and most people religiously follow this because it is simple, yet systematic. Although the envelope system has been around forever, the first ever mention of it is known to be in an 1916 edition of the newspaper, The Evening World Of New York.

How does it work? Identify your major expenses or spending categories. Assign a spending limit and an envelope for each for these. When you get paid, put the budgeted amount into each envelope. And, when you spend, do so in cash and take it out of the right envelope. If you exhaust an envelope, that’s it, you’re done for that period. Some people allow themselves some flexibility and move money between envelopes in case of unexpected spending.

This works best if: You are just starting out with budgeting, you want to cut down spending, you prefer simple systems, you spend largely in cash and if you have a fixed income.

To know more about envelope budgeting, read:

Zero-based Budgets or When You Give Every Dollar A Job

This method has been popularised by personal finance guru Dave Ramsey and boasts fanatic followers around the world. The concept of this budget is simple. You give every dollar a job.

This means you have a clear idea where every unit of your money will go, finally narrowing down the difference between your income and expenses plus other outflows to zero. Suppose you earn $2000 a month, your savings, spending, investment, charity, gifts and every other outflow put together should equal $2000.

The rationale behind this method is that once every dollar has a job, there is no money left to waste on unwanted expenses. You are creating a detailed road map for your finances before you actually start spending anything.

How does it work? List out all sources of income. take note of both your fixed and variable expenses. Write down all the payments you need to make in the coming time period. Start allocating your money to payments till the difference between your income and expenses equals zero. Track your money and make adjustments periodically. This budget also encourages splitting big annual payments into smaller monthly amounts so that you can save at your own pace and avoid surprises.

This works best if: You are detail-oriented, you prefer plans and order, you love tracking your money down to the last penny, you want to cut down spending and if you want to save for goals.

To know more about zero-based budgeting, read:

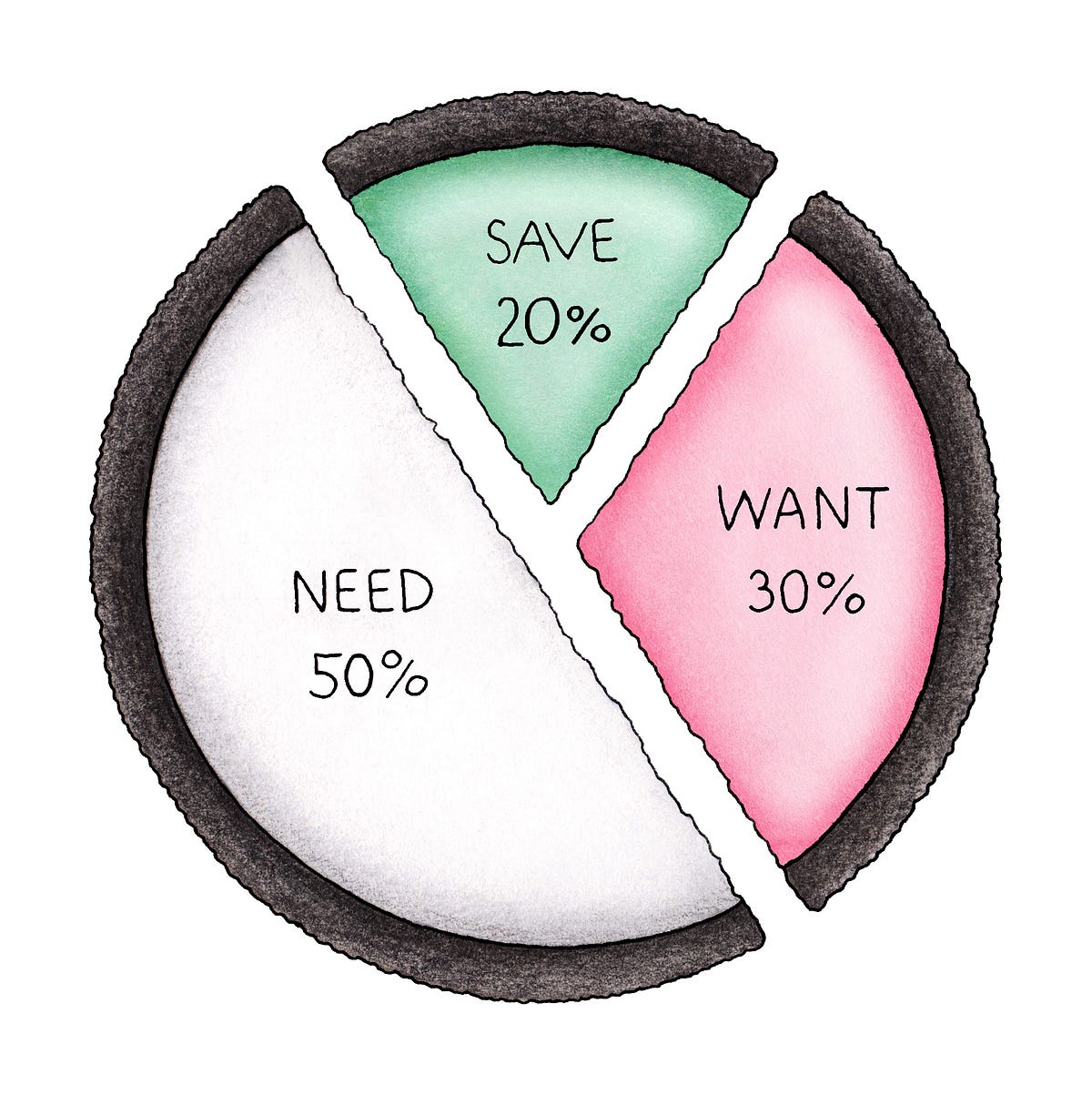

The 50/20/30 Rule or When You Don’t Want To Delve Into Too Much Detail

If you want to follow a budget but don’t want to spend too much time on envelopes or tracking every single dollar, the 50/20/30 rule is your best bet. Essentially, think of this as a broader version of the envelope method. But, in this case, there are only three major things your money will do — pay for fixed expenses, be put away to meet savings or retirement goals and be spent on flexible expenses.

This method was coined by Harvard bankruptcy expert Elizabeth Warren and her daughter Amelia Warren Tyagi in their book, All Your Worth: The Ultimate Lifetime Money Plan.

How does it work? Calculate your income from all sources. Now, decide what all will fall under the fixed category. This varies from person to person. For example, some people may put groceries and transportation in this category, while others may move these to the flexible spending category. Ideally this should involve all your fixed expenses, which you are sure to be making every month.

Allocate 50% of your income to this Needs category. Next allocate at least 20% to savings, investments and debt payments. The rest 30 % is money that can be used to meet your day-to-day expenses or your Wants.

The problem with this budget is that sometimes your fixed expenses are above 50% of what you earn. And, you will find that you aren’t left with much money to divide among the rest of the two categories. If you are stuck in such a situation, use the budget as a guideline and aim to get your finances as close to these proportions. Or, you can follow a different kind of proportional budgeting, which we will talk about shortly.

This works best if: You are not detail-oriented and do not want to constantly track your money, you prefer simple and fuss-free systems, you are new to budgeting, you have relatively less debt to tackle, you want to differentiate between your needs and wants, and if you want to be able to spend guilt-free.

To know more about the 50/20/30 rule, read:

Senator Elizabeth Warren’s 50-30-20 Budgeting Rule | GOBankingRates

The Anti-Budget or When You Don’t Want To Worry About Your Budget

As the name suggests, this one is for those who hate budgeting. Yes, we do think of you, too! The anti-budget mainly focuses on your savings and recommends automating it. Once you decide what you want to save and put that away, then you are free to spend the rest however you want to.

How does it work? Divide your savings into three categories — emergency fund, debt payoff and retirement savings. Set up automated transfers for these three categories from your paycheck. Now, do the same for your fixed expenses such as rent, phone bills, insurance premiums, utility bills and so on. If you are sure how much you need to pay every month, automate it. If not, move an average amount to cover this expense into another account. When you are sure of the amount, make a payment from this account and move the remaining to your checking account. The money left in your checking account now is all yours. No allocations, no percentages and no tracking.

This works best if: You are not an impulsive spender, you are systematic by nature, you don’t have time or patience for keeping track of detailed budgets, and if you want to automate and forget.

To know more about the anti-budget, read:

Use the ‘anti-budget’ to take control of your money without tracking every cent

Proportional Budgeting or When You Want Freedom But Like Some Order Too

This is a broader and more flexible version of the 50/20/30 rule. The idea is the same, that your income gets distributed into three main categories of needs, wants and savings. Warren’s rule is one of the combinations you could follow. Depending on your savings goal, spending plans and fixed expenses, you can fix proportions that work for you.

How does it work? The beauty of this budget is that it gives you both flexibility and order at the same time. You need to prioritize which of the three categories you want to focus on and set proportions for them. If your income is limited and your needs are high, then maybe you will only be able to do a 70/10/20 budget. If you are living paycheck to paycheck, you will be probably doing a 70/0/30 budget. If you are saving aggressively, then maybe your budget may follow a 40/40/20 pattern and so on. Once you have fixed a proportion, when you get paid, allocate money accordingly and follow the budget.

This works best if: You like flexibility, you like being in control, you are impatient or busy to dig into too much detail, you are new to budgeting, and if you want to prioritize how you spend your money.

To know more about proportional budgeting, read:

A Deeper Look at Proportional Budgeting – The Simple Dollar

Making a Choice

You can adopt one of these methods or pick a combination of them to start your own unique budget. For instance, if you like the idea of proportional budgeting, but still want to have some cash envelopes, you could divide your income into the proportions you set and further divide them into smaller, manageable cash envelopes.

The level of customization in your budget depends on you. But remember that the idea is to simplify.

Keep your budget as simple as you can, because only then will you stay honest to it. The moment it starts feeling like a chore, the higher the chance that you will abandon it. So, get started, bake your best budget and create your own road map to financial freedom!

Wallet – system for your financial health

Wallet is available for you worldwide with over 10,000 bank integrations.

It has over 5,000,000 downloads and 400,000 active users.

You can be one of them! Buy a yearly plan with a 50% discount right now!

Find the app on the App Store or Google Play and explore it! Or start by signing up for our WebApp today.