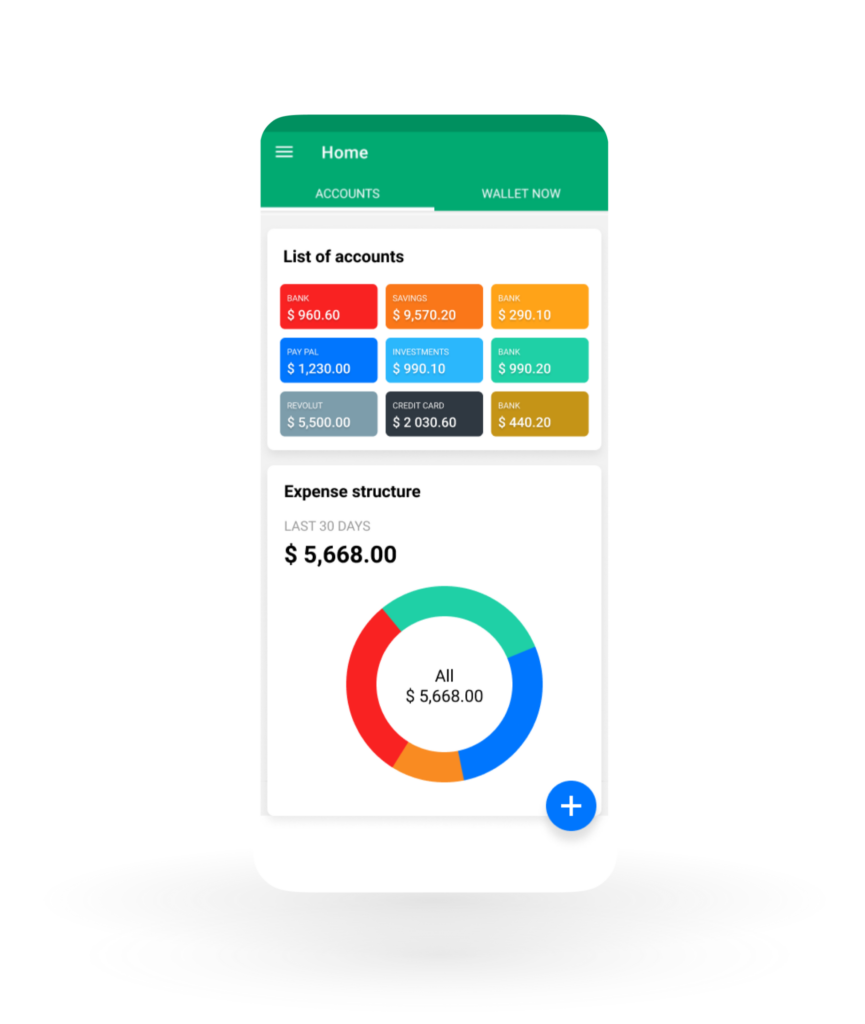

Knowledge is power. You have to know your finances to master them. Wallet is all your money in one app, under your control, wherever you may be. By syncing automatically with your financial accounts, Wallet can help you predict and plan for a richer life while saving money every day.

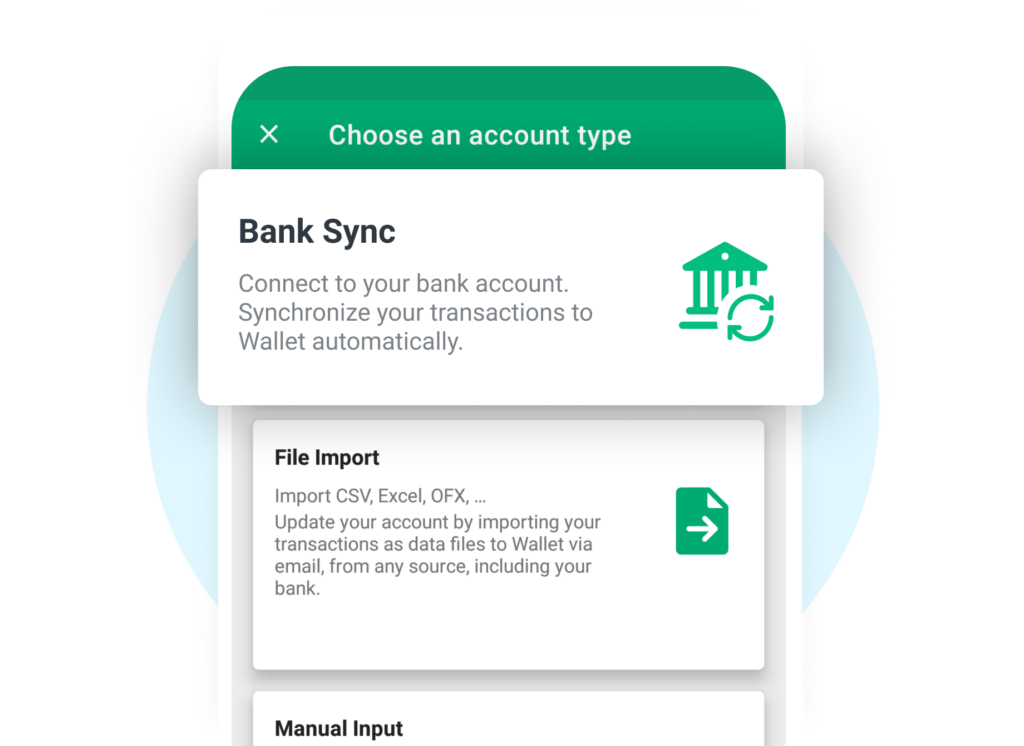

Choose from over 15,000 banks and providers

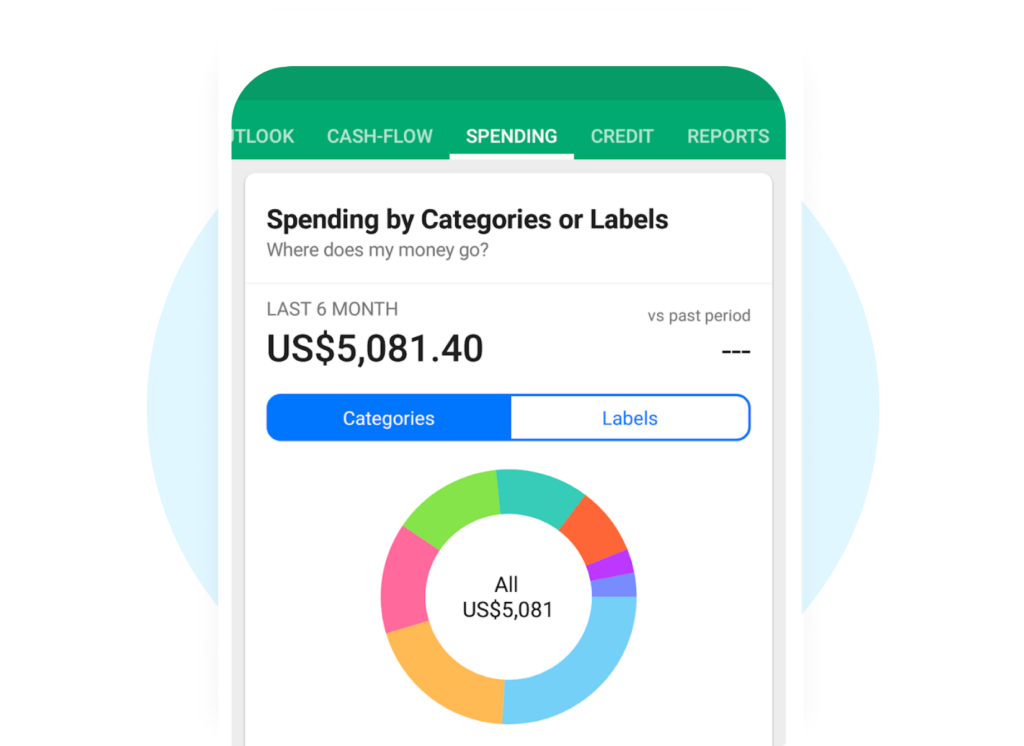

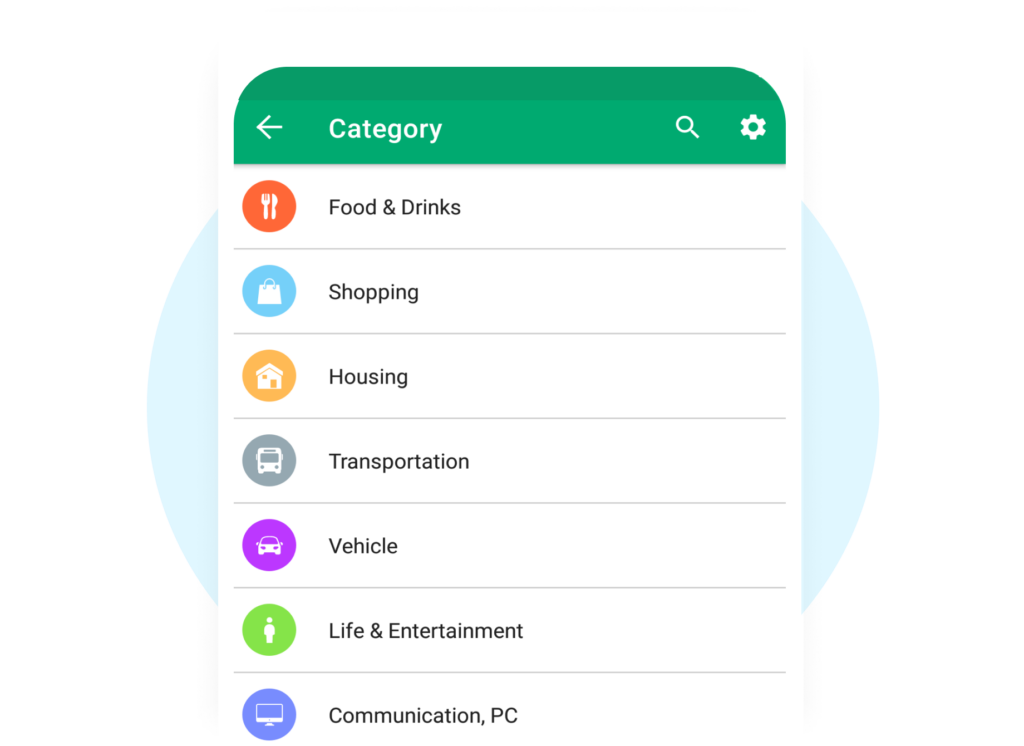

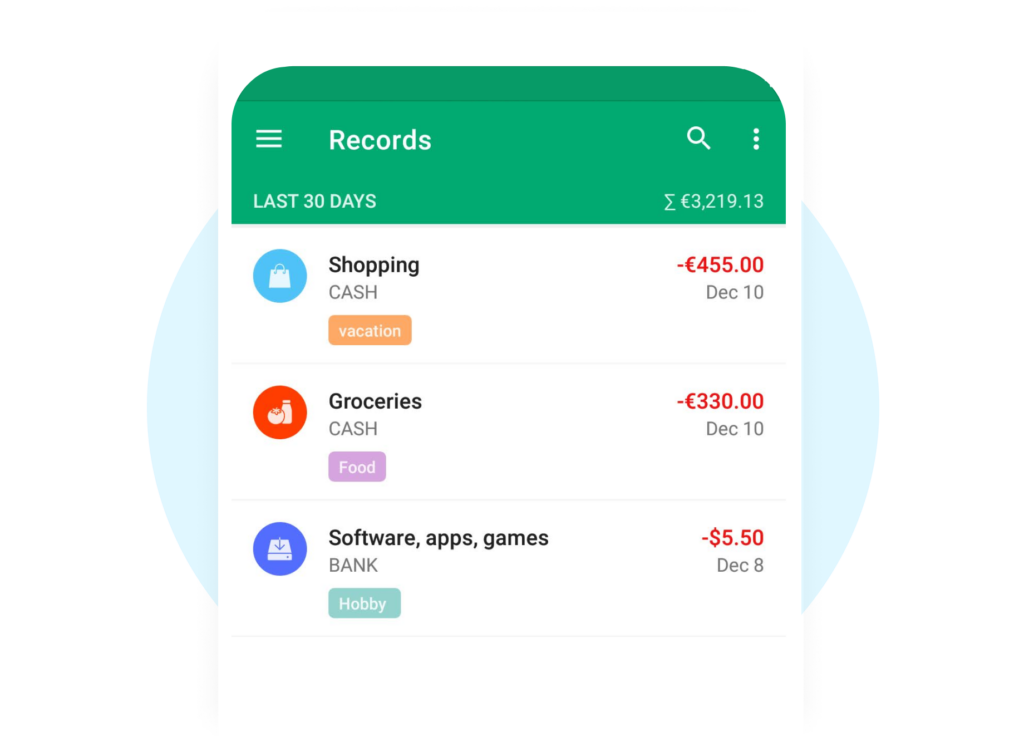

Wallet will automatically categorize spending

Each day offers new insights and opportunities to improve

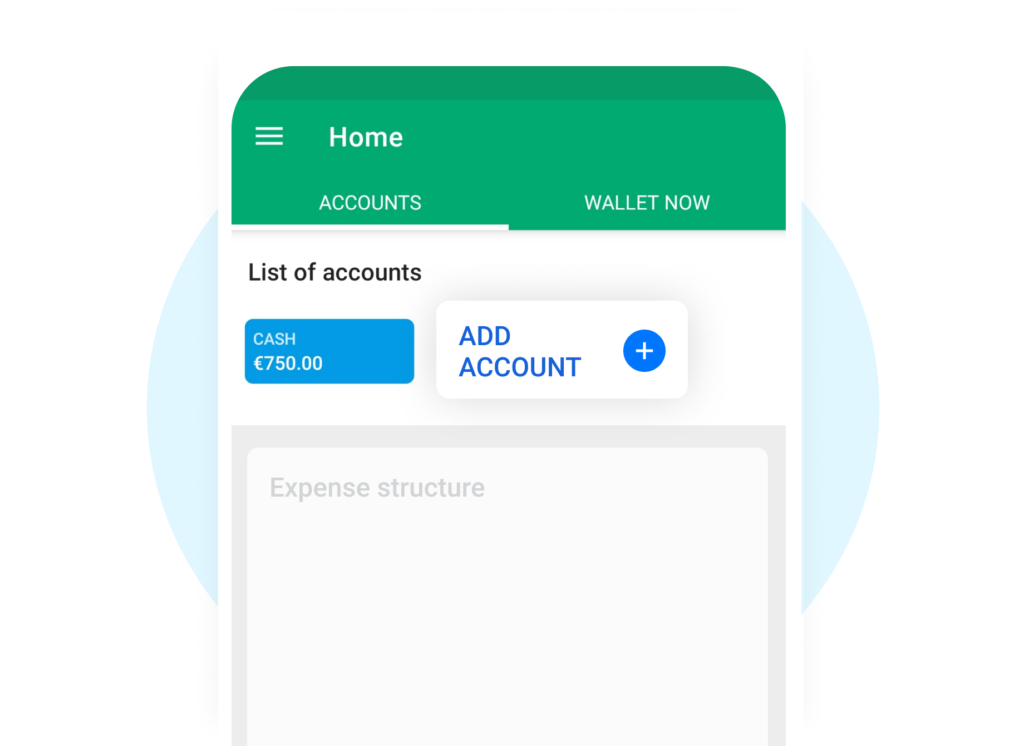

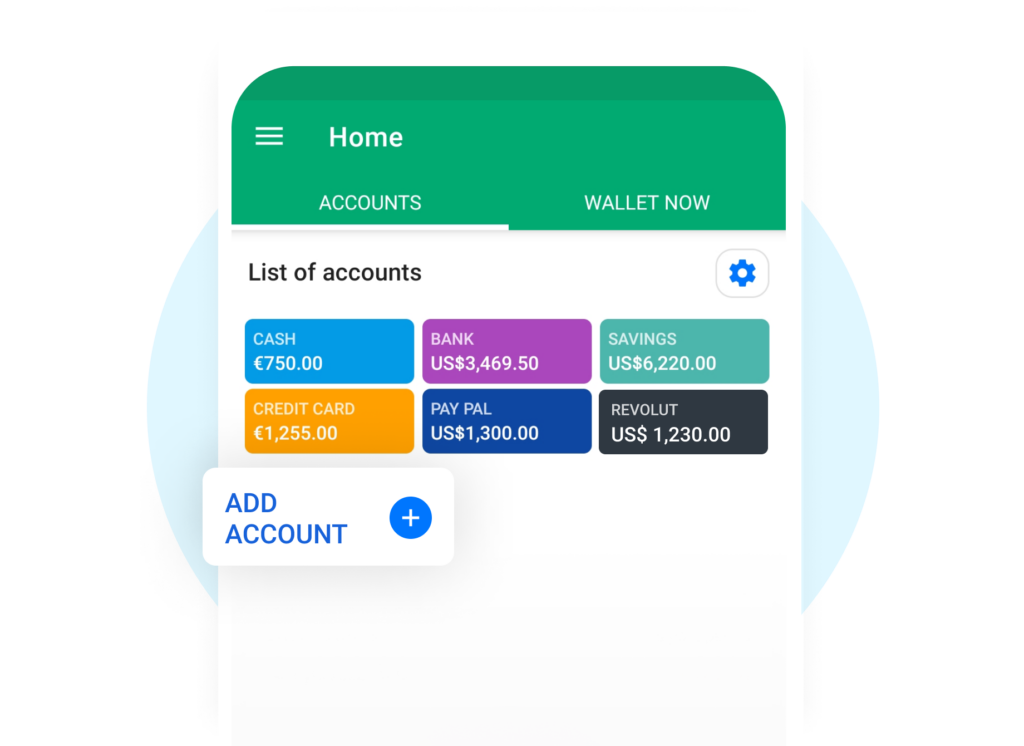

Add as many financial accounts as you own, in any currency

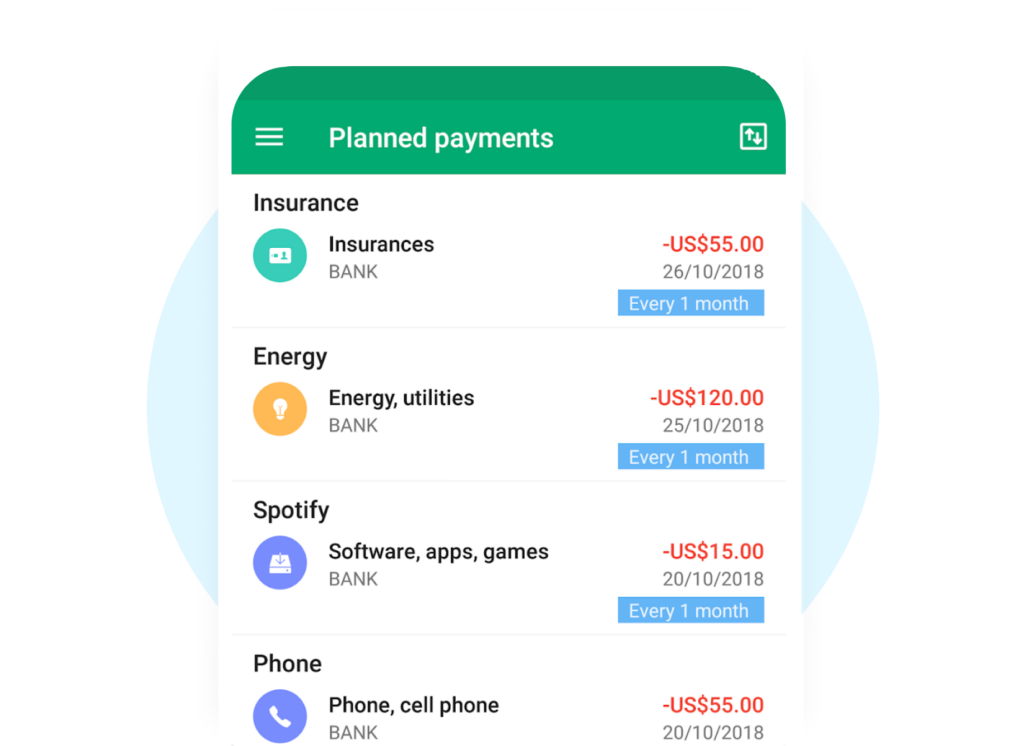

The machine learning algorithms will learn how your finances work and slowly take over for you.

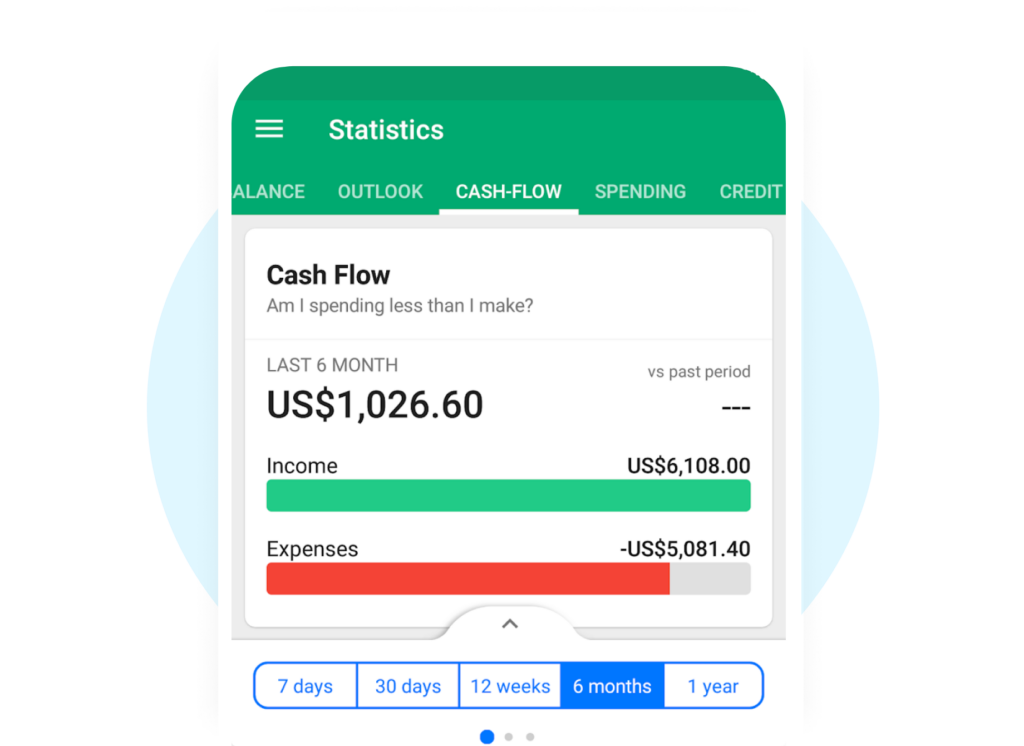

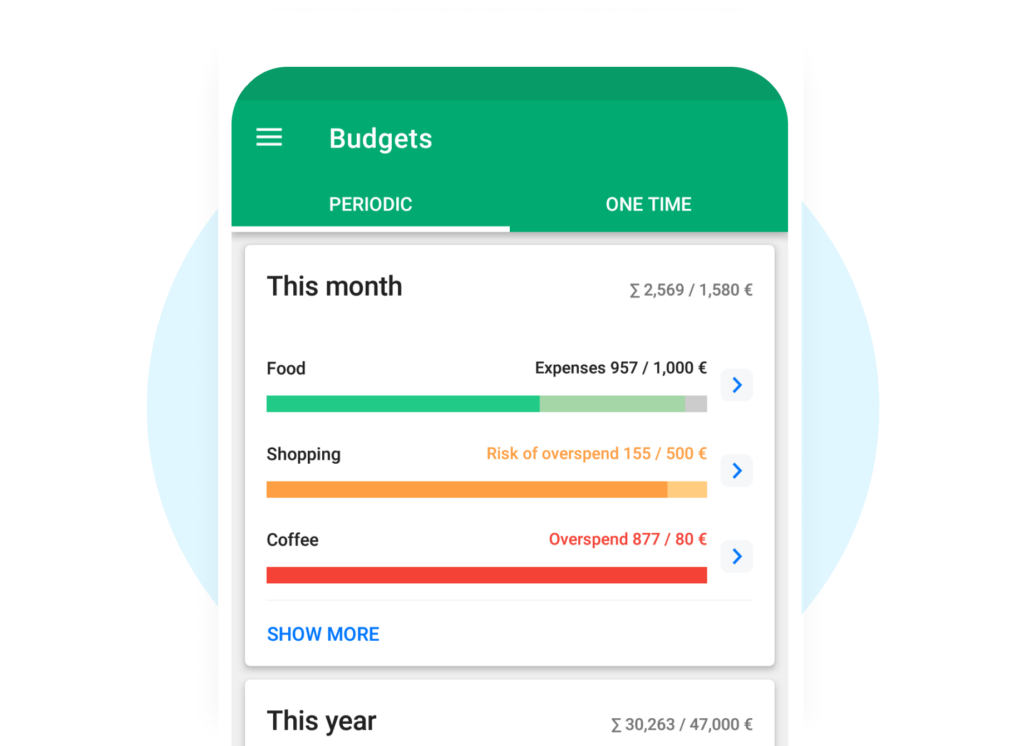

Begin to see how your money situation looks, and project it out into the future.

Start predicting your financial situation weeks and months ahead.

Create detailed categories that track all kinds of spending.

Use your new personal finance superpowers to exercise real total control over your money.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |