If you’re like the average Wallet user, you probably use Wallet no more than once or twice a day to check your daily spending. That’s what our research shows: most people fall into a pattern of checking their balances, plus incoming and outgoing payments on a regular basis.

On the other hand, there is a strong minority of BudgetBakers out there who are… a bit more detail oriented than that. The data visualization addicts. The statistics nuts. The over-achievers. The planners.

We love all our users, but these types are often the hardest to please. There are always things they’d like to be able to see, that they can’t do with Wallet yet. Hey, it’s you’re data, and you should be able to use it the way you want, right?

So how to balance these two groups of customers? The majority, who just need to perform a quick check of their daily spending, and the data addicts, who want to know everything about their finances all the time?

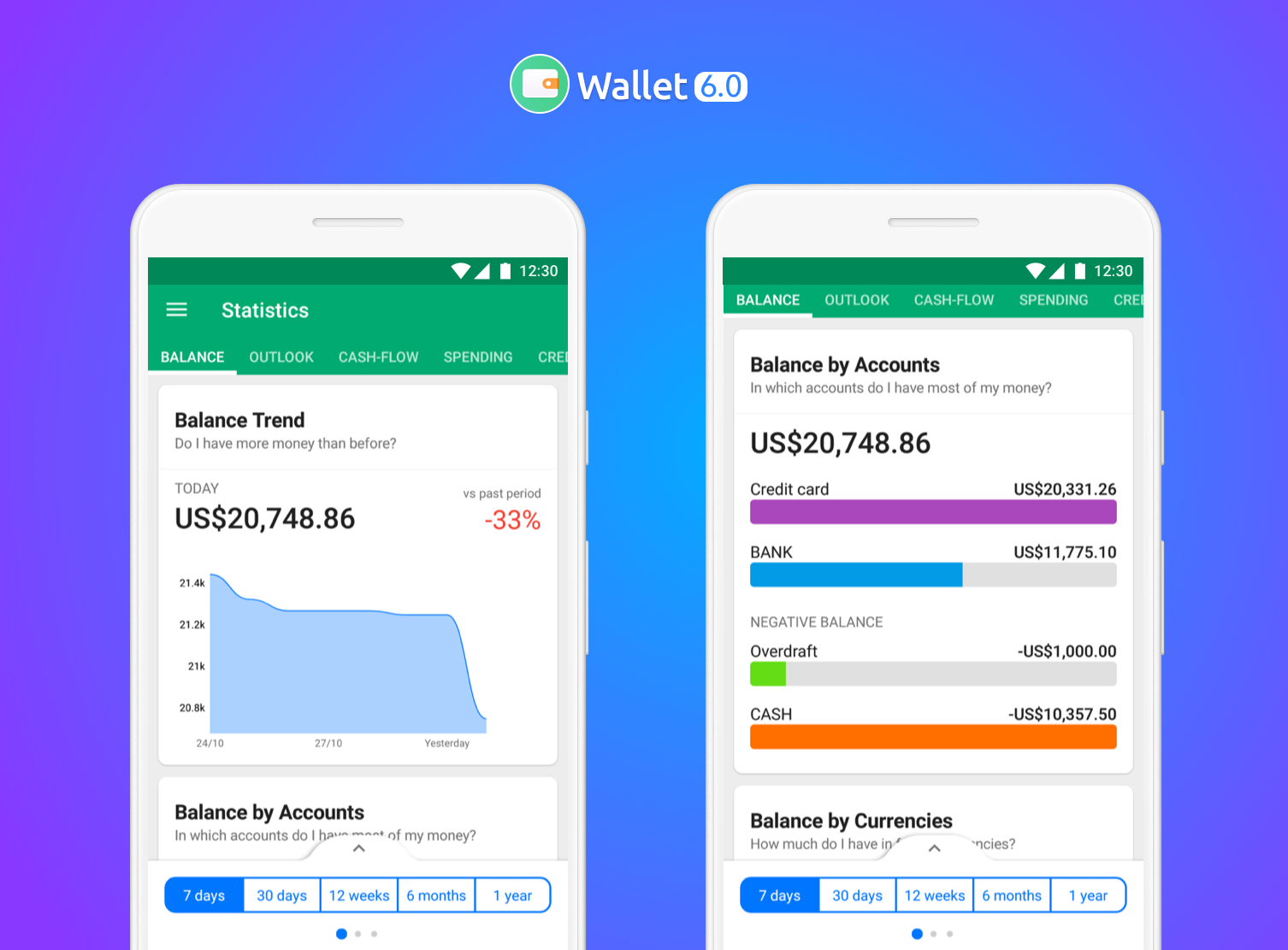

Well, you may have noticed something new in the latest version of Wallet (Version 6.0). It’s a new of working with your financial data that is inspired by the way you, our customers, think about your finances and use the app.

It’s the new Wallet Dashboard. Think of it like the dials on a car: the Dashboard allows everyday Wallet users to quickly make sure they’re staying on budget and keeping their spending under control. It also allows power users to take a deep dive into 6 seperate areas of their finances to check on their long term performance and goals.

What we think is really special about Wallet 6.0 is that for the first time, you’ll be able to use Wallet not only to track your past financial performance, but also to “predict” the future, within the next 7 days. And this is all achieved, not with a dry slate of numbers, but with a clear and easy to read set of gauges. Red, Yellow, and Green. That’s all you need most of the time.

Balance and Cashflow

The most important items that you’re most likely to check every day are your available account balances, and your “cashflow.”

Of course, your balance is the total amount of money in all your accounts. Something casual users may not be as familiar with is the concept of “cashflow.” Cashflow means, basically, the amounts of money coming into and going out of your accounts over a given period.

If more money is leaving my account than coming in, this is “negative cashflow.” If more money is coming in than going out, it’s “positive cashflow.” A healthy financial situation is one with a neutral or positive cashflow into the future. An unhealthy financial situation, then, is one in which money is leaving your account faster than it comes in, setting you up for a potential overdraft, or an unnexpected shortage of funds.

Thus, the easiest way to make sure you’re on track for the next week is to check the cashflow gauge. If it’s in the red, that means you’re going to be spending more than you make during that time. If it’s in the green, that means you’re doing alright.

And for those that want to know why they’re in the green or in the red, that data is just a click away. Clicking on your balance or cashflow gives you a look at your balance broken down into accounts.

When you scroll down, it shows you your balance trend over time.

Here you can also switch between all the other indicators to see details on other meters.

Outlook and Spending

Your outlook is similar to your cashflow, but projected into the future. By clicking on the outlook or spending gauges, you can dig deeper into the spending that is coming up, and get an idea of how much you’re able to spend now, versus in the future.

Again, a red indicates that your outlook is not good. You need to stop spending money, or at least slow down, until the indicator goes to green. Likewise, your spending gives you an indication of whether you have been spending too much recently. If it’s red, that means that you’ve spent a lot recently and should slow down. If it’s green, that means you’ve been spending less than you could.

Expect your spending gauge to go to red before your outlook gauge. This is because as spending increases, the outlook for your future budget gets worse. Likewise, it may take some time for your outlook to improve, once you get your spending back under control.

Credit and Debt

Finally, the last set of indicators are for your credit accounts, and your debts. Credit and debt are similar, however with one important difference: debt is only what you have to pay back. Credit is what you can still potentially borrow or spend.

A credit card normally works as what is called “revolving debt,” which means that you have a specific limit to how much you can borrow on a card, but as soon as you pay back any amount, that amount becomes available to borrow again. Carrying balances on your credit cards however can be more costly than other forms of debt. Thus, the gauges will be more sensitive in regards to large amounts of credit card debt.

Minimum payments on credit cards usually don’t erase the principle amount owed. These types of debts are usually high interest. This means you will need to pay the card back as quickly as you can.

On the other hand, a debt such as a loan tends to have a fixed payment schedule, and is not the kind of debt you can renew as you would a credit card. Thus, the important measure with a debt is whether you are keeping up with your planned payments.

For example, if I had $1200 of student debt, and I have 12 months to pay it back, I should set future payments to $100 per month at minimum. If I do so, my debt meter will be right in the middle. If I increase these payments to $200, my debt meter will be green. If I don’t pay, and my debt gets bigger or stays the same, my debt meter will start to dip into the red.

Meanwhile, my credit meter tells me how much money I have available, versus how much I have already used. If I have a $1000 limit on my credit card, but I have only spent $100, then I’ll be in the green. If I’m getting close to my limit, I’ll be in the red until I get that paid back.

It’s usually more important to pay back credit cards and other high interest debts more quickly than other debts. This is why the credit meter is more sensitive than the debt meter. That being said, there are usually high penalties to missing planned debt payments, so it’s important to make these payments regularly, and on time.