While global climate change may be confusing the birds and the trees this year, it is still technically spring across the Northern Hemisphere (sorry Australia!). It’s time to clean up your budget!

A new year, a new pile of bills you may want to look into. Most of us collect at least a few unwanted services here and there that we can cancel, but a deep cleaning of your budget means more than just cancelling that video streaming subscription you don’t really use anymore. It also means establishing better planning habits for your future spending.

A new year, a new pile of bills you may want to look into. Most of us collect at least a few unwanted services here and there that we can cancel, but a deep cleaning of your budget means more than just cancelling that video streaming subscription you don’t really use anymore. It also means establishing better planning habits for your future spending.

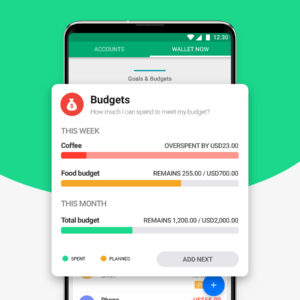

So here are 11 (or more?) tips on how to thoroughly Spring Clean Your Budget. This will be a mix of money saving, and smarter money spending habits you can establish with the Budgeting features in Wallet.

(Note: All finks to features in this post are for Android Users. IOS users can still find these tools in their app)

Budget Killers: Identify Potential Bulk Purchase Items

You may already bulk purchase some items, but you might not realize that there are items you buy or use on a near daily basis that could be purchased in bulk. Think of stuff like your coffee capsules, your dishwasher capsules, your vitamin capsules… In fact anything that comes in capsules might be a good bulk purchase opportunity. You can spot these items in Wallet in the Statistics section, under the Spending heading.

By switching over to Labels, you can view specific labels that get used the most in your transactions. Investigate these to determine which of your daily or weekly purchases are items you could buy in bulk to save money.

Not to mention: little trips to the grocery store can add up to big expenses. Cutting down on your shopping time also cuts down on unnecessary purchases.

Eliminate Your Wasteful Bulk Purchases

On the other hand, many purchases that we make in bulk turn out not to be such great deals. This can happen because we don’t end up using the items before they expire, or because they weren’t such a good deal to begin with. This happens a lot with foods and cosmetics, particularly items in large containers that can go bad.

To try and identify your bad bulk purchases, building and maintaining Shopping Lists really helps. With Shopping Lists, you can make notes to check the unit prices on items you buy in bulk. Compare unit prices to non-bulk packaging, and see if you’re really saving money in the first place. Next, anything you throw away because it’s expired, you should go back to the purchase of that item and make a note about it. This way the next time you think about buying that item, you’ll remember that the bulk purchase didn’t work out that well last time.

It’s also a good idea when making Shopping Lists, to note the items that have short expiration dates.

Get More Out of Your Internet and Phone Budget

Does your internet and phone service renew automatically every year? There’s a reason the cable companies and mobile operators don’t want to renegotiate your deals, and it’s usually because you’re paying more than you have to, for service that is slower or more limited than it needs to be.

As data caps and speeds rise, internet providers don’t always pass the savings on to the customer. Sometimes they’ll allow your old service contract to extend even when they have newer service packages that cost less, and deliver more.

Plus, in many countries mobile operators offer cash rebates on phone purchases, and even 0% financing on new devices, like phones and tablets. Typically these deals run for 2-3 years.If it’s been that long since you updated your contracts, give these companies a call. It’s very likely they have a better offer waiting for those who do. Check your Budget in Wallet to see how much you pay for internet.

Budget Your Subscriptions

You can use Wallet to track your online subscriptions by identifying purchases as recurring. Once a purchase is set as recurring, you can find information about it in the Planning section under Planned Payments. You can also manually add these payments to this section in case one hasn’t occurred already.

You can use Wallet to track your online subscriptions by identifying purchases as recurring. Once a purchase is set as recurring, you can find information about it in the Planning section under Planned Payments. You can also manually add these payments to this section in case one hasn’t occurred already.

You might be surprised how much you spend on online subscriptions, particularly if you have a family. Our data shows that a typical family spends about $800 a year on subscription services. That may surprise you, or it may not. But do you need every one of those services every month? Probably not.

Automate a Savings and Investment Budget

Speaking of monthly payments, there may be another category of items you actually do want to “set and forget.” These are savings or investment payments. If you already have a master monthly spending budget, then adding a savings or investment category is easy. It’s also easy to set up planned payments for a new investment or savings fund, and set recurring payments in your bank management software to either a 3rd party investment fund like an IRA, or a separate savings account that is “off the books” when it comes to your monthly budget.

Conservatively, personal finance experts recommend you try and save or invest at least 25% of your net monthly income — meaning 25% of the money left over after taxes, social, and medical insurance payments. That can be a lofty goal for some of us, but the higher your savings and investment is earlier in life, the more money you’ll have later on.

This is particularly true for investments: a simple mutual fund that tracks the S&P 500 would have returned nearly 10% per year on average over the last 30 years. This would mean that a recurring monthly investment of just $100 would have returned $245,000, including nearly $100,000 in interest after just 10 years.

Does that number astonish you? It shouldn’t. You can use free tools like the Interest Calculator to find out for yourself how much compounding interest really multiplies your wealth.