Your budget, just like any other part of your busy life, deserves a spring cleaning. That’s why last time we shared 5 Tips on how to spring clean your budget. Now we’re back with 6 more tips on budget spring cleaning.

Think we’re missing a good budgeting tip? Give us a shout on Twitter or Facebook.

Stack Your Interest Payments

One of the most classic household finance errors is to pay debts in the wrong order, with the result that you end up paying more interest than you absolutely have to.

The easiest way to go about handling your interest payments is the following:

1. List all your household debts in order of the interest rate of each debt. Typically credit card debts are the most expensive, followed by car loans, then home equity, mortgage and student debt.

2. Determine the minimum payments necessary for every item of debt, and budget these using the Wallet budgeting tools. You can even create a separate “debt repayment” budget with planned payments for your debts.

3. Any extra money available in the budget should go to paying down your highest interest loans. Assign as much of your budget as possible to repaying these.

Kill Your Credit Card Debt First

In the case of credit cards specifically, a common mistake is to carry a balance on the card because you have assigned your money to other expenses.

However, if you have cash available to pay down your credit card debt, you are financially better off doing that first, and then using the credit card to cover your monthly expenses.

This is because typically a credit card debt only starts accruing from the end of one billing period, meaning if you start the month with zero debt on a card, and you pay the balance the next month, you have in effect paid 0% interest on the money you used that month.

Therefore if you have $1000 in the bank, and $1000 in credit card debt, you should virtually always pay off the debt right away. In fact, a surprising number of people carry credit card debt, even when they have cash savings in the bank.

This is because of the mistaken assumption that it’s better to have some money in savings than to have no balance on a credit card. Of course, that’s what banks want you to think!

Employ One-Time Budgets to Plan Ahead

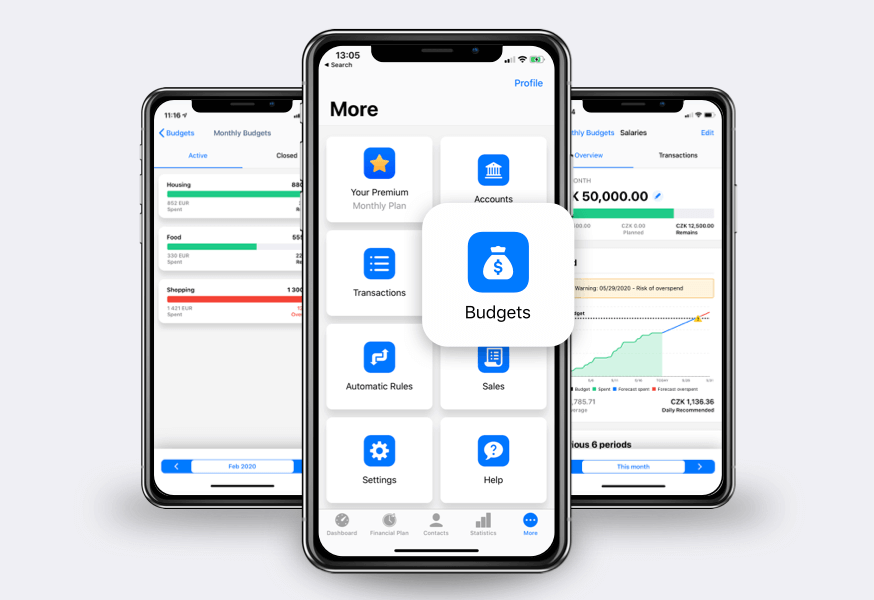

Wallet is a flexible budgeting system. We think not every person needs zero sum budgeting, or strict expense controls for everything in their lives. Everyone’s needs are different.

One thing that many people need and don’t use, however, is One–Time Budgets. One time budgets are great for planning both long and short term spending that doesn’t conform to your monthly budgeting schedule.

For example, a birthday party or a holiday are expenses you save for and plan for many months in advance. What happens often is that you’ll set a savings goal, and fail to meet it, or you’ll meet your goal, and then overspend on the special item anyway. We’ve all made that mistake!

A one-time budget is good for both saving up in advance (by forcing you to assign money to that budget over a given period in advance), and for controlling expenses once that money becomes available to spend. That’s what One-Time Budgeting is for: those big or small things that don’t conform to our daily, weekly, or even monthly plans.

Buy Lifetime Software Licenses

Ok, this one is a bit self-serving, but the advice is still good. When available, lifetime software licenses are almost always financially smarter than paying monthly, or even yearly for a software you actually plan to use.

Software services companies make a lot of money from customers forgetting or simply neglecting to upgrade their monthly and yearly licenses to perpetual licenses.

That’s why BudgetBakers always encourages our customers to purchase lifetime licenses. Ok – there’s our product plug!