Written and fact-checked by financial expert

Lloyd

Today may well feel like one of the worst times imaginable to buy a home. Indeed, interest rates are the highest they’ve been in decades, and the prices of homes in most developed regions are out of reach even for the average middle class buyer. That’s why millions of people are currently struggling to find an affordable property and wondering how to budget for a house.

That being said, traditionally the best time to buy a home is “5 years ago.” Historically speaking, it’s very seldom a mistake to “hop on the property ladder.”

The reasons for this are in a sense, simple, but in another, quite complex. The long and short of it is that modern economic and monetary theory treats property, especially homes, as a primary store of wealth. Developed countries are generally committed to keeping the prices of property stable or rising. And they will do almost anything necessary to accomplish this. That in turn makes an investment in property historically safer than almost any other. Nothing is guaranteed, but if there is one class of investments that governments are committed to protecting, it is property ownership.

Today we’ll be talking about how home financing works. And we’ll be discussing some of the basic logistics of how to budget for a house, what it costs, and what you can expect from the process.

How Home Financing Works

Let’s begin assuming that you know basically nothing about buying a house. Where do you start?

How a Mortgage Works

Before looking at properties, you should work out how much you can afford. Most people finance their first home through a standard mortgage. An agreement with a bank to buy a home, and pay back the loan over a period of time, often 20-30 years. While the home is being paid back, you pay interest on the loan principal to the bank. In essence, you “co-own” the home with the bank. The house is “collateral” for the amount of money you owe. That means the bank can take it back if you fail to pay.

In some countries like the United States, where the government guarantees some home mortgages (meaning the government will ensure payment if the buyer fails to make payments), these interest rates tend to be lower. Other factors can also determine the interest rate you must pay. Including how good your credit score is, whether you are a veteran or government employee, where the house is located, and whether you buy homeowner’s insurance, and life insurance.

The rate of interest can be “fixed” for a specific length of time, typically 5-10 years. At which point you must renegotiate your mortgage or seek another bank to take it over. The rate can also be fixed for the lifetime of the loan. However, this is not common in all countries, and may mean a higher overall interest rate. However, doing this reduces the risk that rates will rise over the life of the loan.

In addition, the amount you borrow and the interest rate can depend on how much you pay as a “down payment.” This is a significant part of the price of the home which you pay at the beginning. By doing this, you lower the overall amount of money you are borrowing. This ensures to the bank that they are unlikely to lose money if you default on the loan. Down payments can range from nothing, to 30% or more, depending on the property and the terms of the loan.

If you default on a home loan, the property will be “foreclosed” and sold to pay back the debt owed. So when you buy a home, it’s important to be reasonably sure you will be able to pay your monthly payments for the life of the mortgage.

What is LTV?

LTV is an important concept when it comes to owning a home. It means: “Loan to Value,” and it’s a ratio usually expressed as X% of Y Value. I.e: 20% LTV, means that your loan is worth 20% of the value of the home.

A typical beginning LTV is 80%, meaning that the mortgage is “worth” 80% of the home value. Over time, as you pay interest and principal to the bank, your LTV goes down. Another thing that makes your LTV go down is the value of your home rising, according to the housing market. Or if you make physical improvements that raise your property value.

Let’s imagine an example: John buys a home with an 80% mortgage, giving him an LTV of 80%. Then he changes the house’s windows, upgrades the insulation, replaces the roof, and the neighborhood also improves. Houses in this area go up in price. After 10 years, not only has John paid off a large part of the mortgage through monthly payments, but also his improvements and market forces have made the home more valuable. Even if he has only paid of another 20% of the principle in that time, his LTV may have dropped to 40% or even lower. In some cases, LTV can drop even faster. If the value of your home doubles or triples over the course of 10 years, then your LTV can go from 80% down to 40% or even 20%.

An LTV of less than 100% means you are “above water,” meaning you owe less than the home is worth.

Or we can consider the opposite catastrophe scenario; one that was experienced by many buyers in 2008 when the values of their houses dropped rapidly. People who had taken 100% mortgages (or even in some cases, over 100% mortgages), and had not paid much of the loan back, found that their houses were suddenly worth less than they owed on their loans. This is called “being underwater,” and it is one of the most common reasons for a buyer defaulting on their loan and surrendering their home to the bank. The good news is that if you do get underwater with a home, you have the option of simply surrendering the home to the bank. Since the bank holds only the home as collateral, in most countries, they can only recover the home, and will not be able to collect the full amount of the debt. This risk is the reason we pay interest, since the loan is a risk on the part of the bank.

Rising interest rates are a sign from banks that they consider this risk to be higher than usual.

Why Buy a Home?

There are a number of reasons why you might prefer to buy a home. But it’s not always right for everyone. People who have uncertain careers or who move often might not buy homes, or may start with a small “investment home” which helps them to build wealth by renting it out to tenants in order to cover the mortgage, allowing them to benefit from the rise in property values over time.

In the best case scenario, buying a home saves you a significant amount of money over time. This is because unlike a rental, the monthly costs of financing a home are generally easier to predict. Over time, as you pay down the amount of money you owe, it’s likely (but not certain) that your LTV will drop. This means that your expenses are not likely to rise in the future, even as inflation continues to rise over time. Effectively, particularly with a fixed rate mortgage, you are being asked to pay the cost of the home at the time you bought it, and not what the current value happens to be.

There are mortgages with “floating rates,” which do rise as the home value increases, but these loans are much more risky to the buyer, and are often given to people who cannot comfortably afford the property they want.

Another reason to buy is to grow your wealth. Over the life of a typical mortgage, you may pay two times the original value of the property, or sometimes even more. However, in 25-30 years, a property’s value has a good chance of rising even higher. Though you may pay out twice the original price, the home may be worth three or four times more by the end of the mortgage. In best case scenarios, buyers end up with a home that can be worth 10 times what they originally agreed to pay.

Still, most experts agree that you should only buy a home with the intention of living in that home for the life of the mortgage. In this way, you benefit the most from a fixed cost of loan payments, even as pay rates and inflation continue to rise.

Budgeting For A Home

There’s no sense in starting the process of looking for a home without a clear picture of whether you’ll be able to afford one. And we’re sorry to say that the costs of home ownership are significantly higher than most buyers are led to believe. It’s better to be as conservative as possible, and assume that everything is going to cost much more than you hoped.

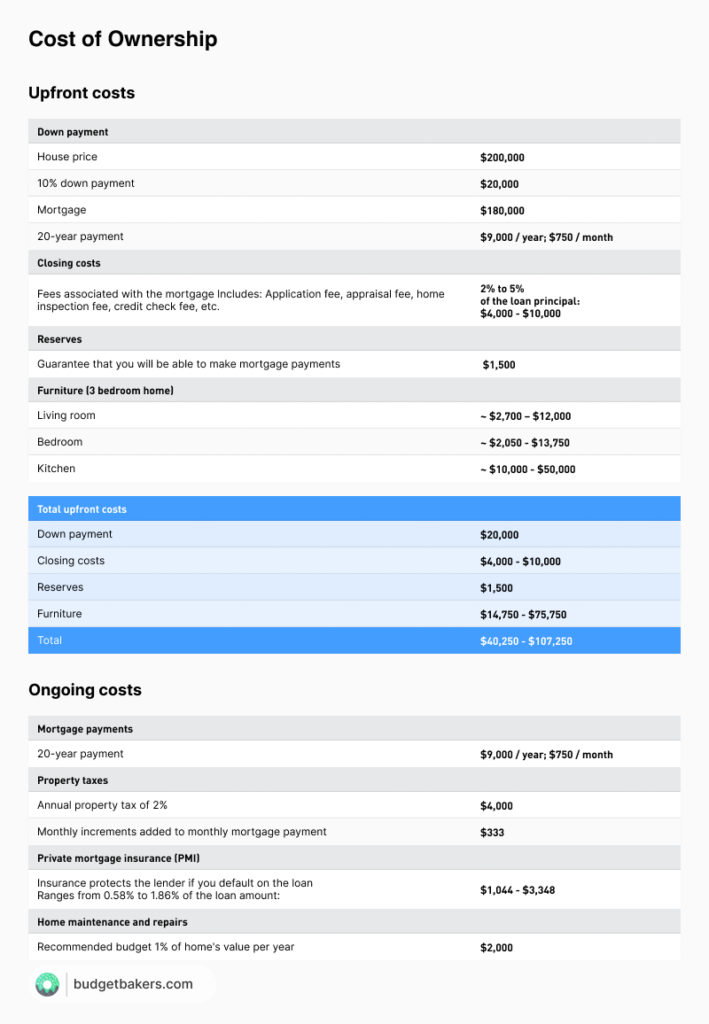

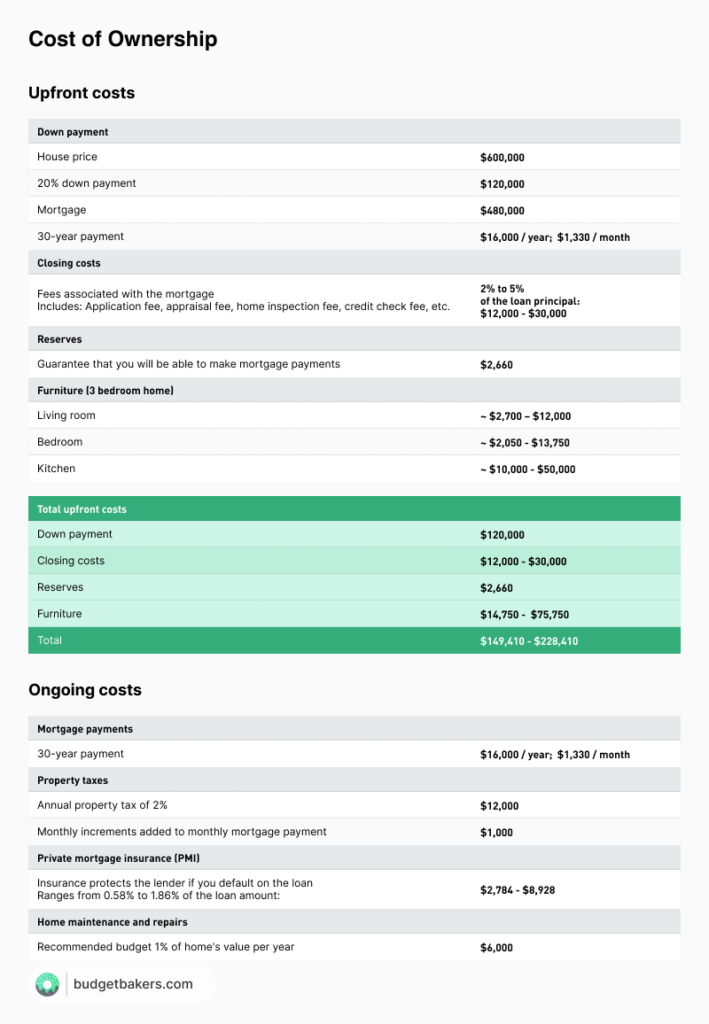

In the two charts below, you can see two examples of how to budget for a house. We listed two different properties with two different loans. One house costs $200,000 dollars and is financed by a 20-year loan payment of $750 per month. The other house costs $600,000 dollars, it’s financed by a 30-year loan payment of $1,330 per month. There are additional upfront costs such as closing costs, reserves and furniture. Then there are ongoing costs, which include the monthly loan payment plus property taxes, insurances and maintenance of the house.

Raising a Down Payment

Even when you’ve just begun working, its never too early to begin saving for a down payment on a home. A good rule of thumb is to look at the typical purchase price of a home an area you’d like to live, and to calculate how much you’ll need to save for at least a 20% down payment.

There are several things to consider: First, the amounts of money you can save early in your career may be less or more than what you’ll have later on. Those who keep their expenses as low as possible, earlier in their careers, are in a better position to buy later. Let’s look at a couple of examples of typical buyers to see how it can work.

Spendy Bob

Spendy Bob is 23 and he’s got his first job. For Bob, it’s party time. He spends most of his disposable income going out with coworkers and friends. He has saved a small emergency fund ($5000), but thinks he needs to wait for better pay in order to think about buying a house. When Bob gets a raise, he spends it on nice things.

But Bob has several problems. He might like to get married in his late 20s or early 30s, but he lives downtown, and the rents are rising faster than his pay can match. He feels trapped. When he turns 30 and starts looking at houses, he realizes that he’d need to save the equivalent of two years of salary just to make a down payment. Bob ends up living in a rundown house far out past the suburbs.

Don’t be like Bob.

Saver Sarah

Saver Sarah, well, saves. She got it into her head at an early age that she would own her own home by 30. She calculated that in order to do this, she would need to save 20% of the price of a future home, plus an additional 10% for unavoidable expenses that come with getting a new place to live. She’s already 22, so she has a lot of work to do.

She has her heart set on a small but stylish home in a quiet neighborhood. It currently sits at about 300,000. A 20% down payment is going to cost about $60,000, and that’s before inflation and rising home prices.

She figures that in the next 8 years, the value of this home will probably rise by 5% per year, meaning the eventual down payment on such a home is going to be about $90,000 by the time she can afford it.

So Sarah buckles down and does the math. To save $90,000, she’s going to have to start saving $900 a month right now. But she also knows that her pay is likely to rise in the future too, so her monthly payments can rise by 1% a year. In addition, she puts her money into a money market fund with moderate risk. She uses a free online calculator like this one, and finds out that if she starts at $900 a year with 1% yearly increases and an effective interest rate of about 3%, she’ll end up with $100,000.

Be like Sarah.

The good news about doing things this way is that as the years go by, the amount of accrued interest jumps proportionally to the total amount you’ve saved. By the last year, she’s making $3000 in interest alone.

So while $900 is certainly a large amount to save for somebody who is only in their early 20s, it is a sure path to being able to afford a home by the time you’d like to be getting married and having children. If you assume that your future spouse or partner will also be doing similar savings, the benefits are even greater.

Compounding interest is truly one of the miracles of the banking system, and the earlier you take advantage of it, the better off you will be.