It is hard to build a habit, we know. Especially if you are young, bustling with work and raring to go. It’s only natural then that you may not always have the time, energy or interest to track your money.

Jeffry Manhulad, an IT specialist from Pasay City, Philippines, was also stuck in this rut. He would start tracking his money and be motivated for a few days, but soon feel lazy and give up on his efforts. However, with time and patience, Jeffry managed to fight his way through laziness, his busy schedule and lack of time to bring order to his finances and peace of mind.

And, he credits this successful lifestyle change to Wallet! “Wallet taught me the single-most important thing in managing money, which is, self-discipline,” says Jeffry. Having been hooked to Wallet for more than 2 years, Jeffry is one of our “super users”. He uses almost every feature of Wallet, to suit his own needs, and has brought about significant positive changes to his finances.

“Wallet taught me the single-most important thing in managing money, which is, self-discipline.”

Wallet has become an inevitable part of Jeffry’s daily life and he has also introduced his partner to the app. We caught up with him to chat about the different ways he uses Wallet and how it has changed his life and finances. Here’s Jeffry’s Wallet story!

Hi Jeffry! Tell us about how you started using Wallet and what all you use it for.

I’ve been using Wallet for more than 2 years now. I started using the app in January 2016 and really maximized the free version of Wallet until August of 2017, after which I decided to go Premium. Right now, I use Wallet for money management such as budgeting, income and expense tracking, debt management and also investment tracking. I also use it to share and split bills with my girlfriend.

I found it while I was searching for a money management app on Google Play. Before I stumbled upon Wallet, I had already tried tonnes of money management/expense monitoring apps, but none of them met my expectations. When I tried Wallet, I was hooked and I’ve never uninstalled the app. It has become a part of my daily life. I have even written about Wallet and my experience managing money with it on my blog: 8 Most Useful Android Apps I Won’t Probably Uninstall and Things I learned after 1 Year of Tracking My Expenses Using Wallet by BudgetBakers. My success with Wallet has inspired me to write more about it so that others can also use it to their benefit.

That’s great, Jeffry! What do you consider your biggest achievement to date with Wallet?

That’s great, Jeffry! What do you consider your biggest achievement to date with Wallet?

The biggest change that Wallet brought about in my financial life is self-discipline. I knew that before I could budget my money, I had to understand where my money was going. Using Wallet made this step very easy.

When I started using Wallet, my first goal was to track my spending, hopefully adjust my habits and eventually manage my spending so that I have enough funds for savings. But this was too complex and challenging a goal to start with, I soon realised.

So I decided to break it down and achieve them in phases. I used to get lazy to track my spending for days and then all the information would be messed up and then the thought of giving up kicks in. Every time this happened, I asked myself whether giving up on tracking my money would lead me to my achieving my financial goals. And, I found myself always saying no. So, then I convinced myself to continue.

So I kept at it and made Wallet a part of my daily routine. Before going to bed, I always checked Wallet, counted my money down to cents and checked if the amount in the app and the actual money in my purse matched up. That was the first major achievement I had with Wallet.

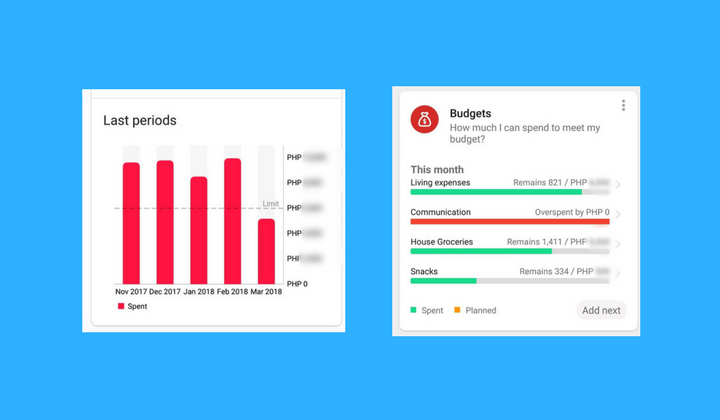

After overcoming that first challenge, now my next goal is to stick to my budget. It is really easy to set up a budget and then end up overspending. And, I am no exception to this. In Wallet, I can at least see it when it happens and be aware. I have also started using Wallet’s recommended daily spending and I’m happy to say that, this month might be the first ever month in which I actually could stick to my budget for living expenses.

So my advice is it take it step-by-step. Your finances won’t change overnight. Build the right habits first and the change will follow on its own.

You also mentioned that you split bills with your girlfriend using Wallet. Can you explain how you do this?

I’ve been living with my girlfriend for a while now. So I record all our common expenses like groceries (using Labels). Then, at the end of every month, I add up all these expenses and split the amount between us. She would just pay me half the expenses if I had ended up spending more than 50% of it during the month, and vice versa.

What about budgeting? How do you budget on Wallet?

I have been following the budget taught by Hong Kong billionaire Li Ka-Shing, in which you divide your earnings into 5 types of funds: 30% for living expenses, 20% to expand your interpersonal circle, 15% for your funds to learn, 10% for travelling, and 25% for investing.

On Wallet, I created 5 different Labels and every time I record a transaction, I label them using one of these 5. I have also created corresponding budgets for these 5 funds. And, I use templates for recurring transactions. This means I don’t waste time filling notes and descriptions for every transaction. Of course, sticking to a budget is not easy, and almost always I overspend in the living expenses category. But the beauty of using Wallet is that you can look at the charts and reports and see where you went overboard and make necessary changes.

What are your favourite features on Wallet?

My favourite feature is Labels. This is the most useful feature for me and I use it all the time. Almost all my records have labels, except for transfers and debts. Labels has been very useful not just for my budgets, but also for my splitting bills with my girlfriend.

My next favourite is the Debt module. This feature is just very handy. You don’t have to worry about remembering all the people who owe you money. Aside from the very useful features which I use almost daily like charts, reports, planned payments, goals and others, the next feature I will highlight is the Loyalty Cards. I have this loyalty/membership card for a particular money remittance company here in the Philippines, and the staff was amused when I showed them my loyalty card on Wallet. That way I have decluttered my physical Wallet also.

What is the biggest lesson you have learned about money after using Wallet?

The biggest lesson I have learned is that in order for me to manage my money wisely, I have to know exactly where my money goes.

And, how has your attitude towards money management changed after using Wallet?

At the end of 2017, I spent time analyzing my spending habits to prepare myself for the new year. I looked at the reports and charts and realized that I had already saved and even started investing money. Without Wallet, I would’ve never had a complete picture of my spending habits. And, I wouldn’t have seen the progress I was making in terms of finances. My progress keeps me inspired to pursue my goal of reducing my spending and increasing my savings.

Over to you

Has Wallet changed your spending habits?

Share your Wallet story with us and get featured on our blog! Send in your experiences to us at jan@www-2.budgetbakers.com. Make sure to write “Wallet helped me!” in the subject line. We can’t wait to hear from you.

Still not using Wallet? Click here to give it a try.

Follow BudgetBakers on Facebook, Twitter, Linkedin and Instagram to get more updates from us.

Did you enjoy reading this? Why don’t you share this and help your friends get their finances in order?