Across the world in the last two years, millions of people have been forced -or indeed, finally permitted- to reevaluate the conditions in which they live and work. Many have begun, if not to openly demand reforms in our ways of working and living, then at least to formulate their grievances and discuss them.

Online communities like /r/antiwork have traced the rise in interest from younger generations in better social and labor conditions, particularly in places like the United Kingdom, and the United States, where the social safety nets are notoriously weak and only becoming less functional with time. These are not merely communities in which people complain: they are also a springboard for action.

Interest in labor organization is on the rise, with big companies like Amazon making concessions to unions for the first time. Petitions for the formation of unions in the United States jumped 57% last year, according to US federal data. Once union elections are called, they are adopted ¾ of the time, indicating that unions are able to promise workers better options than private companies are willing to offer.

Things That Really Keep us in Poverty

It has become practically obligatory for big financial institutions to lecture people about “financial responsibility,” often displaying how completely out of touch many of these institutions truly are with the way most people live.

We’ve discussed this problem at length in past blog posts

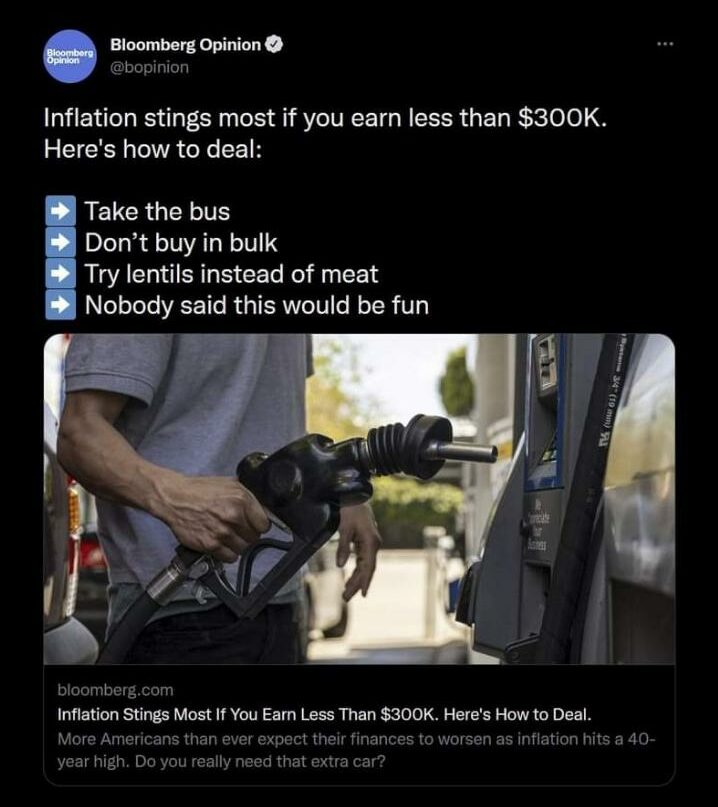

Tweets like this gem from Bloomberg demonstrate that there is a financial elite in the western world who have no idea what normal life looks like, much less how to improve it.

So let’s be bold! In a series of posts, we will highlight some of the real causes of poverty and lack of economic opportunity, and point to the potential solutions for those problems. Be warned: no finger wagging about avocado toast and $5 coffees can be found here. We’ll be addressing serious and deep economic issues that impact the way millions of people live.

For today’s installment:

Predatory Debts

The problem:

It will come as something of a shock to our European and worldwide readers, but millions of Americans have tens or hundreds of thousands of dollars in outstanding student loans, not to mention other lines of credit at high interest. What has been termed a “student debt crisis” has seen the total debt owed by American households for university fees grow to over $1 trillion.

Most of these payments were frozen during the pandemic, with interest not accruing, but those freezes are ending, and many people are left with debts far too large for them ever to pay down. Even more shockingly, US law allows federally guaranteed student loans to be immune from bankruptcy protection, meaning that people cannot get out of these debts no matter what the circumstances.

Another major problem in the US is medical debt. Again in the United States, two out of every three bankruptcies are due to medical debts and on average Americans pay over $5000 a year out-of-pocket, on top of their already high insurance costs, just for basic medical care.

For context, the BudgetBakers team largely live and work in Prague, the Czech Republic. Our public health insurance plans cost nothing to employees, and less than $100 a month to freelancers, and there are no copays or other costs of care. Every single person in the country is covered this way, and medical debt and bankruptcy are unheard of.

We know what you’re thinking: surely we pay for this with our high, high European taxes? Not so. The average tax bill for residents of Czechia is a little under 25% of income. Guess what it is in the United States, on average? 23%. Just 2% more, and we have all of our healthcare costs covered.

How to Fix it:

These problems are deeper than just debt, and they can’t be completely encompassed by one description. However change is possible. Serious debt reform is needed, particularly in places like the United States and the UK, where predatory lending are endemic and highly destructive to the financial security of the working poor.

In addition, new laws should remove federal protections for student loans, which would allow many bad loans to be discharged through bankruptcy, or force lenders to renegotiate loans, particularly those loans on which the borrower has already paid most or all of the original principle. Beyond that, the President of the United States can, and should, unilaterally dismiss a large portion of federally guaranteed loans, as he has already done for certain classes of workers (such as public employees).

It sounds trite, but talking about this problem and calling your government representatives about it can make a difference. The more people acknowledge and single out the problem, the more pressure they can bring on the political system to change it.