Researched, written and fact-checked by business editor and financial expert

Leonie Bauer

What is inflation and what causes it? These are questions that most working people today are asking themselves, and each other. Prices are going up across the board, in almost every country, and in almost every category. The news tells us that prices are rising, but rarely do we hear a real, honest discussion about what causes this to happen, much less what we can actually do about it.

That’s what this series of posts aims to do. We’ll discuss what inflation is, the true causes of inflation, and what to do about it from a variety of perspectives, from a minimum wage worker to a small business owner or someone with a larger income looking to make smarter long-term money decisions.

In times of change, misinformation and motivated reasoning often drown out both the simple and the complex truths. What we hope to accomplish with this series of posts is to demystify complex economic phenomena, and provide you with a solid foundation from which to make good decisions.

Key Takeaways

- Inflation generally means that the value of money falls and prices rise. Low inflation can help boost economic growth.

- Deflation is when the value of money increases and prices go down. Consumers tend to postpone purchases, which leads to production stoppages and job losses.

- Central banks can increase the supply of money and increase interest rates to control inflation.

- When inflation is high, it is advisable to borrow money and pay back debts very slowly. Now is the time to make large investments and lock in interest rates.

For the purposes of this discussion, we can simply say that inflation generally means that the value of money is going down, while the prices of goods and services are going up. This is in contrast to deflation, which is what happens when the value of money increases, and/or the prices of goods and services are tending to go down.

Most modern monetary systems view inflation per se as a good thing, as long as it is controlled. A big reason for this philosophy is that the opposite scenario, one in which deflation takes hold and prices continually fall over a long period, can lead to economic catastrophe. On the contrary, mild inflation of ~2% helps economies to grow and prosper.

Why does inflation help economies grow? As economies grow, they become more productive and more efficient. What it cost to make a widget last year should be lower this year because our knowledge of how to make that widget is better this year, and the infrastructure we have developed around making widgets should have improved.

But if economies become more efficient, and we expect the cost of making widgets (in this case a widget is just an economic term meaning “a thing”), to continually drop, this can lead to deflation.

So targeted inflation is a way of making sure that even though you become more efficient over time, the value you can get from selling widgets will not drop as a result of that increased efficiency. If this were not the case, then economic productivity would be punished by ever-dropping prices, and people would have very little incentive to improve their products or productivity. If making better widgets didn’t mean making more money, then people wouldn’t try to improve anything.

Why is Inflation Happening Now?

Economics dissertations could (and will!) be written about what is causing inflation at this moment. What’s important to understand as a consumer and a participant in the economy is that inflation can happen for many reasons, and usually there is more than one single cause.

While it is popular to argue that inflation right now is being caused by the creation of so much new money during a decade of “quantitative easing” in OECD countries, the truth is that over the very short term, most price inflation is caused simply by large corporations raising their prices. They do this not only out of greed, but also because they anticipate that their future costs will increase. As inflation increases, these actions become a self-fulfilling prophecy, with companies raising prices, which drives employees to seek higher wages, causing other companies to raise their prices, and so on.

A great deal of what drives inflation in the short term is mass behavioral phenomena. While changes such as wars, interest rates, pandemics, and shifts in the underlying economic conditions do definitely have their roles to play, the truth is that inflation can happen simply because we believe it will happen.

Listen to the related episode, “How Expecting Inflation Can Actually Create More Inflation,” by Michael Barbaro and Jeanna Smialek, hosts of The Daily podcast by The New York Times.

The reasons

Nevertheless, here is a little list of “the usual suspects” for inflation over the medium to long term:

- Shortages of goods drive up prices (housing, cars, computer chips)

- Shortages of labor drive up wages

- Shocks to industries caused by wars and climate change

- The global pandemic

- The creation of new money

- Political upheavals and uncertainty about the future

- Taxes on the rich and corporations being too low

Any of these can and do have their effects. But anyone claiming to know exactly what is causing inflation today is probably selling you something you shouldn’t buy.

The Menace of Deflation

Why is deflation so dangerous? Imagine you have $100 today. The cost of a widget is $100. You need a widget. In a stable and growing economy with mild inflation, you can expect that buying this widget today will cost about the same as waiting a week, or a month to buy it. But with mild inflation, you know that the cost of that widget a year from now, will be a little more than $100. So what do you do, given that waiting to buy that widget is going to increase the cost to you? You buy the widget.

Inflation helps consumers and businesses by giving them a small encouragement to make investments today, in order to avoid losses in value to their money in the future. If inflation is rising faster than the money I can make keeping my cash in the bank, I have an incentive to go out and buy something today. This applies to everything from consumer goods to stocks. Making investments in good and financial products today makes sense if inflation is eroding the value of my money.

But under deflation, prices are continually dropping. This means that if I have $100 today, it makes logical sense for me to wait a week, a month, or even a year to buy a widget. Thus I may pay only $90 for that widget in a year, and I will have saved money. This is known as the Paradox of Thrift. It states that when consumer prices fall continuously, consumers learn to postpone their purchases and wait for a better offer.

It doesn’t take much imagination to predict what happens when everyone is hoarding their money and no one wants to buy widgets. Widgets stop getting made. Salaries stop getting paid. Pretty soon, an economy is headed for collapse. So deflation can be incredibly destructive. In places where deflation has taken hold over a long period, such as in Japan in the 1990s and 2000s, whole decades of economic growth are destroyed until inflation can be encouraged to take hold again.

Some Inflation is Good

So given that the possibility of deflation is so dangerous, some mild inflation in an economy can be seen as a good thing. Prices rise, but salaries also rise. In general, people and businesses are encouraged to make investments today so that they can make more money tomorrow.

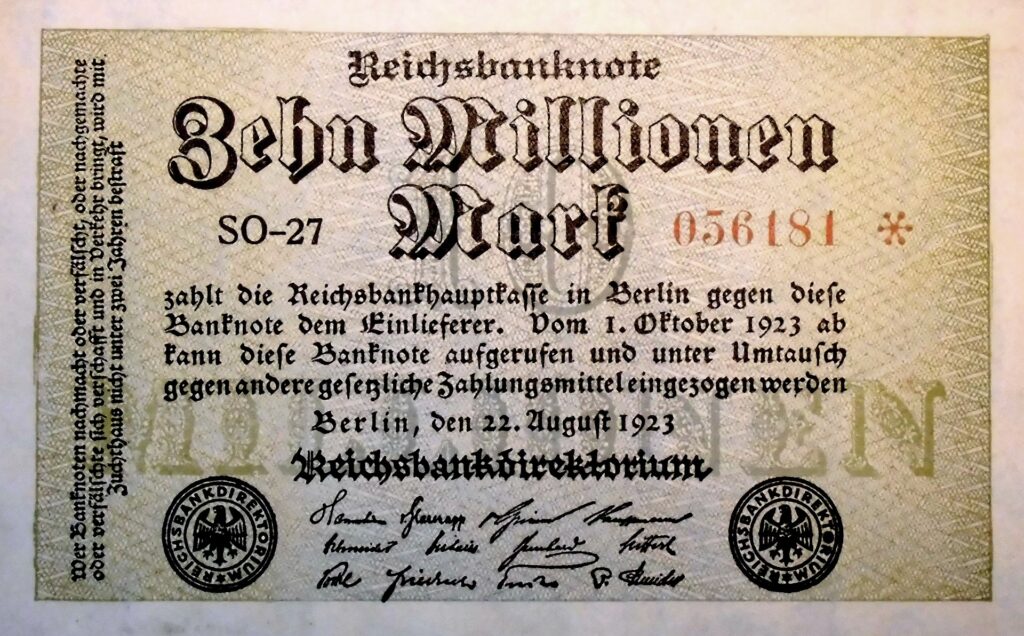

However when inflation starts to get out of control, and rise too fast, weird things start to happen. Many people when they think of inflation, think of pictures of German citizens from the 1930s, who experienced the Weimar Republic’s hyperinflation crisis. Images of people stacking bills in wheel-barrows to buy their bread are reproduced in every history textbook, and inflation is often seen as the boogey-man cause of this crisis.

This is a shame, because this is not actually a very good example of inflation’s real risks in the modern world. The Weimar hyper-inflation, to spare you the very complex details, was not really an economic crisis, but a political crisis. The Weimar government chose to cause hyper-inflation in order to alleviate it from the negative effects of the punishing Treaty of Versailles, which had originally demanded that Germany repay war debts to France and England in the aftermath of WWI.

By causing hyper-inflation, Weimar Germany sabotaged the treaty, and alleviated itself of the burden of paying back these debts. As it turned out for history, the short term pain of doing so caused Germany to experience a period of political revolution and a rise of authoritarian politics that gripped the country for over a decade.

Suffice to say, the Weimar hyper-inflation is not really a realistic scenario for most countries, most of the time. A much more realistic scenario would be found in South American countries such as Argentina or Brazil: places where inflation has taken hold and persisted sometimes for many years. Price rises of 50% a year over a multi-year period can cause devastating economic destruction, much more serious long-term than a short period of hyper-inflation.

This is because persistent inflation, unlike a period of sudden hyper-inflation, can have long term consequences to the way people behave within the economy. Whereas a hyper-inflationary period such as Weimar Germany can be arrested and fixed with a relatively simple change in currency and a period of psychological adjustment, once inflation takes hold in a country, it can have damaging psychological and behavioral effects that last many years. People may become used to prices constantly rising. They may be unwilling to save their money, preferring to always spend it as soon as they have it. This can cause financial instability and an inability for a country to reorient itself to better long-term financial planning and stability.

Safe to say: persistent high inflation is a very bad thing. And unlike with deflation, which is relatively simple (but very painful) to solve, persistent inflation is difficult to stop.

How Can Inflation Be Stopped?

Whereas deflation can be more easily addressed by a change in monetary policy, a new currency and enforced price controls, whereby businesses are forced not to lower their prices as money is continually added to the economy, inflation cannot be so easily arrested.

This is because once inflation starts, businesses have an incentive to immediately spend all of their available money on long-term investments that will become more expensive in the future. Investors too suddenly want to move all of their money from banks into hard assets, such as real estate. Americans have seen this effect as banks and investment companies have begun buying commercial and home real-estate faster than consumers can keep up with. The cost of buying a new home, or even renting a home has in many cases reached higher than the average salary can allow, and this means that many people are stuck being unable to afford to live anywhere at all.

This is because in an inflationary period, these properties will grow in value, while cash will not. It is therefore better to borrow as much money as one can, and spend that money immediately on things that will maintain their value no matter what the currency is worth. But since so many people and businesses all have the same incentive to invest now and ask questions later, prices naturally shoot up.

As prices rise, the opportunity to price gouge and profiteer from the shortage of goods and properties becomes ever greater. However, even as companies book amazing short term gains, they are really shooting themselves in the collective foot. Once they run out of things to buy, and once consumers no longer have enough money to buy goods, or rent properties at the prices that these companies expect to charge, a sudden economic contraction becomes more likely.

This leads to what is called a recession. A period in which economies contract, and less economic activity takes place.

Central Banks Step In

This is where monetary policy comes in. Most modern economies have a central bank which is politically semi-independent from the administrative state. The job of that bank is to protect the integrity of that country’s currency. In the United States, that bank is The Federal Reserve Bank, aka: “The Fed” and it has vast power to dictate the economic situation of the United States.

Through some very complex systems we won’t go into today, central banks are able to increase the supply of money in the economy. If inflation is rising too fast, they can take money out of the economy. If it is not rising fast enough, they can add money. They can also dictate the cost of borrowing, which is one of their most powerful tools.

During the 2008 financial crisis, the Fed took extraordinary steps to increase the supply of money in the economy through a program called “quantitative easing,” which is a fancy way of saying that they created a lot of new money for banks to borrow and lend out at very lower interest rates. This got the economy growing again, but it also introduced a bit of a ticking time bomb. As more and more money was created, asset prices such as stocks and real-estate would rise in value. If the Fed reversed course and began taking money out of the economy again, these prices could suddenly fall off a cliff. Mild inflation could turn into sudden deflation.

When inflation is dropping, the central bank can force commercial and consumer banks to lend out more money by lowering the prime interest rate (the amount of interest deposits can earn with the central bank). When inflation is rising, they can encourage banks to stop lending out money, by raising interest rates, causing these banks to want to save money because the interest rates are attractive.

This is why interest rates on everything from credit cards to mortgage loans have been rising quickly over the past 6 months. As inflation increases, the Fed can raise interest rates to discourage consumers from borrowing money (thus discouraging us from spending more), and encourage banks to save more money and loan less.

Can Inflation Be Stopped?

The last time OECD countries experienced these levels of inflation was in the early 1980s, and interest rates on things like mortgages rose to as high as 18% before inflation began to fall.

Why did it take so long for this to occur? Well, once inflation has taken hold, there are many things working against monetary policy makers. Rises in prices, such as people are experiencing now with the sudden surge in petrol prices or home prices, allow businesses to book insane short term profits. They see an opportunity to raise prices and make profits, but consumers quickly change their habits to consume less, or take fewer financial risks such as not buying a home, or not putting as much money into the stock market.

Once people become accustomed to spending less money, these habits become harder and harder to break. And as prices rise, consumers also seek higher and higher salaries, or work longer hours in an attempt to maintain their lifestyles. With more people working longer and able to buy less, many areas of the economy suffer. Restaurants and cinemas, vacation travel, and transport all suffer as a result.

Eventually prices and salaries must arrive at some new balance, but probably not before many areas of the economy suffer enormous losses. Many jobs in the process will disappear. Many careers will be fundamentally altered. These effects are now all but inevitable. The only question is how bad the situation will get before it can be stopped.

What Should I Do During Inflation?

This is where we enter the realm of speculation. It’s important to state once again, what we said at the beginning: we are not qualified to give you financial advice, and you should seek professional advice from qualified advisors.

That being said, understanding the dynamics of inflation should help you to also understand what actions are in your interest and which are not.

Right now, inflation has set in, and is unlikely to stop in the short term. Knowing this, some clear rational reactions begin to become clear:

- Borrow Money or pay back debts more slowly

While consumers are gripped by fear that the economy will contract and goods become more expensive, there is also an opportunity present to use inflation to your advantage. If you have previously borrowed money at low interest rates, such as a low mortgage rate or a car loan that is now less than inflation, it is now in your interest not to pay this money back early. If you can, continue to make the minimum payments, and you will find that as inflation continues, the value of the loan principal will be reduced.

This does not mean you should necessarily go out and borrow cash right now. Holding onto cash carries the same risks of inflation as lending does. The value of money in your bank account will be going down, so unless you have something you need right now, and a way to borrow cheaply to get it, you should be conservative. - Make Large Purchases – Don’t Delay Investments

Have you been saving money for a car, or a new roof? Now is the time to pull the trigger. Yes, prices are rising, but prices are unlikely to fall again anytime soon, and there is no guarantee that they will ever go back to what they were before. If you’re saving money for something, now is the time to get it if you can. - Look for Yield, Not For Growth

During periods of inflation, it is generally better to look for investments that will produce “yield” and not necessarily ones that will produce “growth.”

Yield oriented investing means looking for investments such as bonds with high yields in important core-industries such as energy, transportation, or government. These investments are likely to maintain their value and pay back a steady income. Investments such as speculative stocks and growth bonds are riskier in times of inflation. As prices rise and the economy begins to contract, growth stocks can be among the first victims. You want to seek investments that will maintain their value over a long period. This means looking for steady, mature businesses and financial instruments with solid fundamentals. - Lock in Interest Rates

During times of inflation, one of the most powerful tools of the rich is leverage. The ability to borrow money cheaply, and spend that money on hard assets that will retain their value. They do this in many ways, but the important lesson for consumers is that it is also possible for regular people to take advantage of the same effect. If you’re able to find a bank willing to lock in a low-interest loan today, then it’s very likely that the value of the loan will be lower by the time you’re paying off most of the principle.

With that in mind, borrowing today, if you can do it cheaply, might be a good idea. This is particularly true if you have a hard asset that you’re relatively sure is going to rise in value, such as land, precious metals, or a blue-chip investment with a solid business foundation. This is not meant to urge you to go out and spend money with your credit card – credit cards often come with variable rates and other ways to punish you for profligate spending. But it is to say that if you have a way of borrowing money today and a good, solid investment to make with it, it probably won’t be the worst idea.

Disclaimer: BudgetBakers and its employees are not qualified financial advisors, and the following does not constitute investment advice of any kind. Please contact a qualified financial advisor before making any financial decisions based on this information. This information is purely educational. We take no responsibility for financial decisions made using this information.