Written and fact-checked by business editor

Leonie Bauer

9.1% – That’s the current average inflation rate in the US as of June 2022. It indicates how much more expensive commodities are now, on average, compared with 12 months ago.

Energy and food prices in particular are rising rapidly. According to the Consumer Price Index, groceries account for 10.4 %, and energy for as much as 32.9 % of inflation.

However, these data are based only on the inflation rate of an average American. That doesn’t mean that your personal inflation is equally high. On the contrary, inflation rate strongly depends on your lifestyle and spending habits.

For example, if you don’t have a car, you don’t spend money on fuel and vehicle maintenance. Therefore, your “personal” transportation inflation index is probably lower than the average person.

So what’s your personal inflation rate? Get an idea with our sample calculations. We’ve calculated the inflation index of three individuals based on their energy consumption, cars and travel, diet, food, and childcare, and subtracted it from their income.

Spending habits determine your “Personal Inflation Index”

Let us introduce you to Mary, Javier and Robert. These three sample individuals will help to show different lifestyles and their influence on personal inflation indices.

You’ll see below that each one of them spends different amounts of money on different goods. These include meat, fuel and travel, for example. Those who spend a lot on these categories are experiencing stronger inflation than the others.

Our calculations take into account their rate of inflation, depending on how much more or less they spend on various goods than the average American.

Meet Mary

Mary is 44 years old, lives in San Francisco, California, and has a net income of $152,827. With this salary, she belongs to the upper middle class in America. This allows her a lot of flexibility in her purchases, as she has enough money to buy expensive goods that aren’t so affected by inflation.

You can see this in her choice of car. Since she drives an electric car, she doesn’t have to spend money on gasoline, which is currently exorbitantly expensive.

Also, the share of her income that she spends on other daily necessities, such as natural gas and groceries, is not as high relative to her total income as it is for low-income earners. Thus, she spends only a small portion of her money on currently expensive goods.

Plus, she’s able to maintain her level of consumption by drawing on her savings.

When calculating her personal inflation index, we primarily considered her investments, such as (new and used) cars, and her spending on fuel, travel, groceries, heating, restaurant meals, and child care, as these are the categories that have the greatest impact on the inflation rate.

As a benchmark, we have taken the inflation rate of April 2022, which was 8.5% at that time. As a data basis, we used the inflation calculator of the New York Times.

| Mary | |

| Age | 44 |

| Residence | San Francisco, California |

| Net Income | $152,827 |

| Car Purchases Last Year | 1 (Electric Vehicle) |

| Miles Per Week | 120 Miles |

| Travel | 3 Trips a Year |

| Diet | Vegan |

| Heating | Natural Gas |

| Eating out | 5x a Week |

| Child Care | Private school (1 child) |

Now the question is, to what extent does inflation reduce Mary’s disposable income? Does she experience a higher or lower rate of inflation than the average American?

Average Inflation: 8.50%

| Car Purchases Last Year | 8.40% |

| Miles Per Week | 7.90% |

| Travel | 9.10% |

| Diet | 9% |

| Heating | 9% |

| Eating out | 9% |

| Child Care | 8.60% |

| Mary’s Inflation Rate | 8.60% |

| Monthly Deduction Due to Inflation | $1095 |

| Yearly Deduction | $13,143.00 |

| Available Money | $139,684 |

High Earners Suffer Less From Inflation

Car Purchases

The numbers may surprise you at first: Mary’s purchase of a new car results in a lower inflation rate than the average. That’s because the demand for cars is greater than the supply. And a shortage in the supply of new vehicles immediately drives up demand for used cars, creating a bottleneck that drives up prices here, too.

While the cost of a new car has risen 12.6% since last year, used car and truck prices have risen 35%. In many cases, owning a used car is now more expensive than a new one of the same model. This is also because new cars consume less fuel and so Mary, as the owner, spends less than owners of older models.

Gasoline

Speaking of gasoline. The next factor that reduces Maria’s inflation rate is her mileage and fuel. With 120 miles per week and an electric-powered engine, her consumption is far below the average. Gasoline, on the other hand, raises average inflation so much that electricity as a fuel can lower your inflation rate.

Travel

What raises Mary’s rate above the national average is her travel. With at least three international trips per year, she achieves 9.1% inflation. The price increase is mostly due to high demand following the 2020 and 2021 Covid measures and the current jet fuel prices.

Diet

Her vegan diet reduces Mary’s inflation rate from 9.1% to 9%, as her purely plant-based nutrition means she’s not affected by today’s high meat, milk and egg prices. These have increased by 15% and 15% and 22.6% respectively compared to last year, while general food prices have “only” increased by 11%.

Heating

Heating Mary’s home by natural gas, as opposed to oil, which is used in only 6% of American homes, doesn’t change Mary’s inflation rate, as it is in line with the average.

Eating Out

One interesting factor, however, are her many restaurant visits. Contrary to expectations, these don’t increase her inflation rate, but leave it unchanged at 9%. This is because while grocery inflation is up about 12% year-over-year, restaurant price inflation is only 6.8%.

Child care

The last category, child care, is another interesting one. Because even though Mary has a child attending private school, her inflation rate drops from 9.0% to 8.6%. This is because day care and preschool prices are up 3.6% on average over the past year. This is a burden for many families, but it’s lower than the general increase, thus reducing the rate of inflation.

- Mary’s personal inflation rate is 8.6%, just 0.1% higher than the general average, even though she has a high standard of living. Like all people at the moment, her economy suffers from price increases, but her high income and wealth allow her to limit her inflation rate, e.g. by buying an EV.

- Inflation thus reduces Mary’s annual income from $152,827 to $139,684. Per month, she has nearly $1,100 less to spend.

Meet Javier

Javier is 35 years old, lives in the small town of Ann Arbor, Michigan, and has a net income of $64,355. With this salary, he belongs to the middle class in America. Unlike Mary, Javier has less flexibility in his budget because of his income and location, which gives him less room to reduce his discretionary spending when prices rise.

He has been able to put some money aside over the last few years, which he now plans to spend on increased heating and electricity costs. However, it’s not enough to maintain the standard of living he and his wife and two small children have enjoyed in recent years.

To calculate Javier’s personal inflation rate, we looked at his car purchases, gasoline consumption, travel, diet, heating, restaurant visits and childcare, just as we did for Mary.

| Javier | |

| Age | 35 |

| Residence | Ann Arbor, Michigan |

| Net Income | $64,355 |

| Car Purchases Last Year | 0 |

| Miles Per Week | 270 Miles |

| Travel | 1 Trip a Year |

| Diet | Not Vegetarian |

| Heating | Oil |

| Eating out | 1x a Week |

| Child Care | No |

With this in mind, to what extent does inflation of these goods reduce Javier’s disposable budget? Does he experience a higher or lower rate of inflation than the average American?

Average Inflation: 8.50%

| Car Purchases Last Year | 7.60% |

| Miles Per Week | 7.70% |

| Travel | 7.90% |

| Diet | 7.90% |

| Heating | 10.70% |

| Eating out | 10.70% |

| Child Care | 10.80% |

| Javier’s Inflation Rate | 10.80% |

| Monthly Deduction Due to Inflation | $579 |

| Yearly Deduction | $6,950 |

| Available Money | $57,405 |

Rising Prices of Necessities Hit the Middle Class Hardest

Car Purchases

Looking at categories such as car purchases or travel, Javier’s inflation rate appears comparatively low at first glance. Since he didn’t buy a new (or used) car last year, he can cut his inflation rate by almost one percentage point, to 7.6%, compared to the average.

Gasoline

Javier’s expenses are nevertheless very high. Although he hasn’t bought a car in the last 12 months, he drives long distances every day in an older vehicle because public transportation isn’t available in his region. Given the many miles he drives and the high fuel consumption of his old car, his inflation rises to 7.7%.

Travel

But that’s not all. His vacation at Lake Michigan, to which he and his family travel by car, causes his inflation rate to rise from 7.7% to 7.9% – mainly because the cost of gasoline is so high.

Diet

His rate remains at 7.9% when you factor in his non-vegetarian diet.

Heating

His inflation is skyrocketing in yet another category: heating his home with heating oil. As heating oil has increased by 2.5 times in the last 12 years, families like Javier’s spend a large portion of their income on heating their homes. Although the price of heating oil fell by one dollar per gallon from $4.4 to $3.4 between June and July 2022, experts predict that prices will rise again, especially in the fall and winter.

Eating Out

Also, the prices of everyday food items such as meat, dairy and eggs, which Javier consumes at home, have increased so much in recent months (from 3.7% in August 2021 to 10.4% in June 2022) that they leave his inflation rate at its 10.7% high.

Child Care

The category of child care increases his final inflation rate by another percentage point. This is because, as described in Mary’s example, child care facilities experience a lower inflation rate than the average 8.5%. Children like Javi’s who attend a state institution face average inflation and therefore can’t lower his rate.

- With a personal inflation rate of 10.8%, Javi has almost $7,000 less in his wallet in one year. His monthly income drops by $579 and the annual disposable budget to $57,405.

- Javier is thus a good example of how a relatively low income can limit flexibility and contribute to high personal inflation.

Meet Robert

Last but not least, we’d like to introduce you to Robert. He is 27 years old, lives in New York City and has an annual salary of $33,048. This places him at the lower end of the lower middle class in the United States.

Although Robert doesn’t live an expensive lifestyle and has always been frugal, current inflation is severely affecting him. This is due to his comparatively low salary, which makes it difficult for him to cover his rising fixed costs.

It’s Expensive to Be Poor

Economists believe that this is mainly due to the fact that lower income groups have to spend more money on food and energy in relation to their overall income. They spend comparatively much on precisely those goods that have become a lot more expensive in recent months. If disposable income doesn’t grow along with it, there is less and less left to save.

But how does Robert’s inflation rate compare to Mary and Javier, and to the rest of the American population? Let’s take a closer look at Robert’s spending.

| Robert | |

| Age | 27 |

| Residence | New York City, New York |

| Net Income | $33,048 |

| Car Purchases Last Year | 0 |

| Miles Per Week | 0 |

| Travel | 1 to 2 Trips a Year |

| Diet | Vegetarian |

| Heating | Gas |

| Eating out | Once in Two Weeks |

| Child Care | No |

Robert also faces the question of how much inflation will shrink his disposable money and how much will be left of his salary. Does he experience a higher or lower rate of inflation than the average American?

Average Inflation: 8.50%

| Car Purchases Last Year | 7.60% |

| Miles Per Week | 6.00% |

| Travel | 6.20% |

| Diet | 6.10% |

| Heating | 6.00% |

| Eating out | 6.00% |

| Child Care | 6.10% |

| Robert’s Inflation Rate | 6.10% |

| Monthly deduction due to inflation | $168 |

| Yearly Deduction | $2,016 |

| Available Money | $31,032 |

Robert’s personal inflation rate is 6.1%, more than 2% below average. This may not sound like much at first glance, but it’s nevertheless a significant cut in Robert’s budget. But first, let’s understand the level of his inflation rate.

Car Purchases and Gasoline

Since Robert didn’t buy a car last year and doesn’t own one, he reduces his rate from the average 8.5% to 6%. This is because he doesn’t have to pay exorbitant gas prices that are hitting the rest of the population hard at the moment.

Nevertheless, he spends quite a bit of money on public transportation in New York, which has also become more expensive in recent months.

Travel

However, his travels increase his rate to 6.2%. However, his rate increases to 6.2% due to his travels. He travels mainly by plane or rental car, for which he has to pay indirectly for jet fuel and gasoline.

Diet

His avoidance of meat and preference for tofu and vegetables nevertheless helps keep his rate down.

Heating, Eating Out and Child Care

The rest of his lifestyle helps stabilize this 6%, as he heats his small apartment with gas, eats out once in two weeks, and has no children to pay for childcare for.

- His rate means a loss of $2,016, which reduces Robert’s available budget to $31,032 per year.

How to calculate your personal inflation rate

We hope our examples have given you an idea of how lifestyle and habits affects your personal inflation rate and what a difference your income and assets can make to your financial well-being.

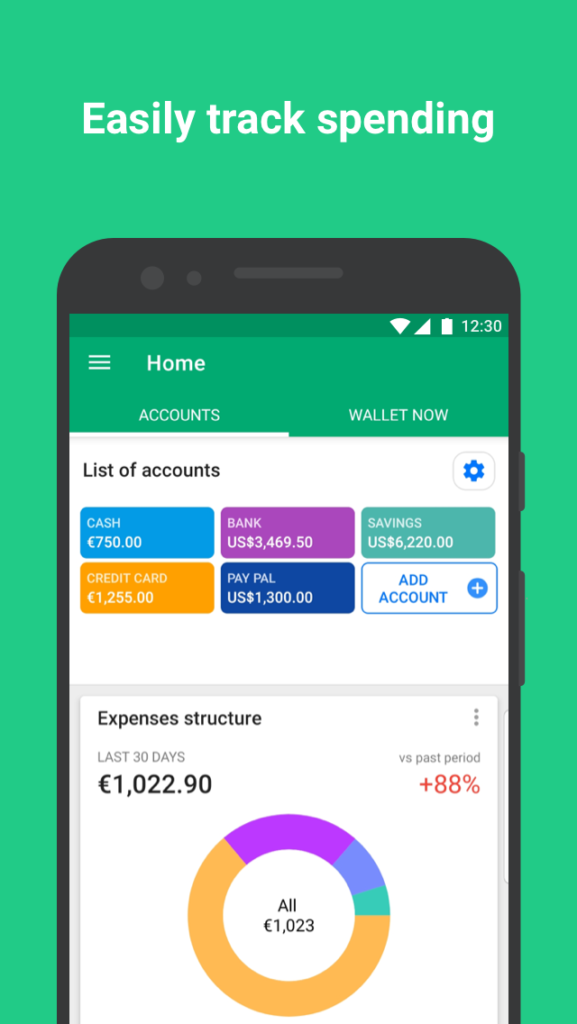

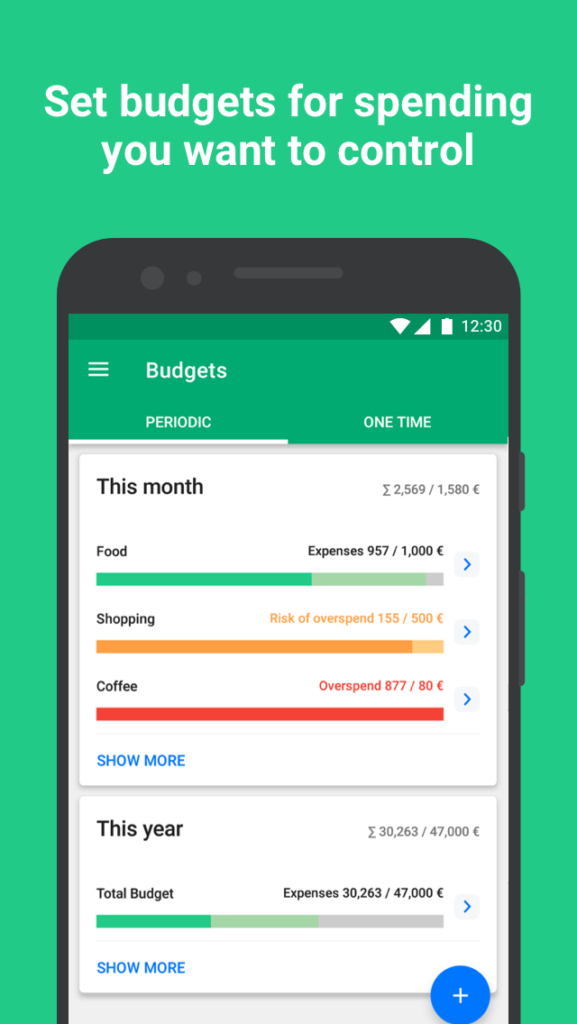

But our samples are just examples. If you want to calculate your own inflation rate, you can either create a table and list your expenses in the most inflationary categories. Or you can use a budgeting app like Wallet by BudgetBakers, which automatically shows you which categories you spend money on and how your spending has increased over the past few months.

The only thing you need to do is to securely connect your bank account(s) to Wallet. The app will then show you where money is going and how much.

You should pay particular attention to the categories that are currently experiencing the greatest price increases. These are groceries, transportation, housing, medical care, recreation, education and communication.

Add up your expenses in these categories for the last month. Make sure to also include any major expenses you pay less frequently, such as annual car and home insurance premiums, by tallying them up and dividing by 12 to get the monthly cost.

Now subtract your total monthly spending from a year ago from your current monthly spending. Then divide this sum by your monthly expenses from a year ago.

For instance, if your spending last month was $3,000, and a year ago it was $2,800, the difference is $300. Divide $200 by $2,700 and you land at 0,074 which means a rate of 7.4%.

This rate is admittedly not very accurate, since it assumes that you bought exactly the same amount of goods last year as you did this month. However, if there were no major changes in your life, such as a move, you can use the calculated rate as a guide.

To learn more about inflation from our financial experts, read our article on what inflation is and what you can do to protect yourself from it, and check out our picks for learning about inflation.