Written and fact-checked by business journalist

Leonie Bauer

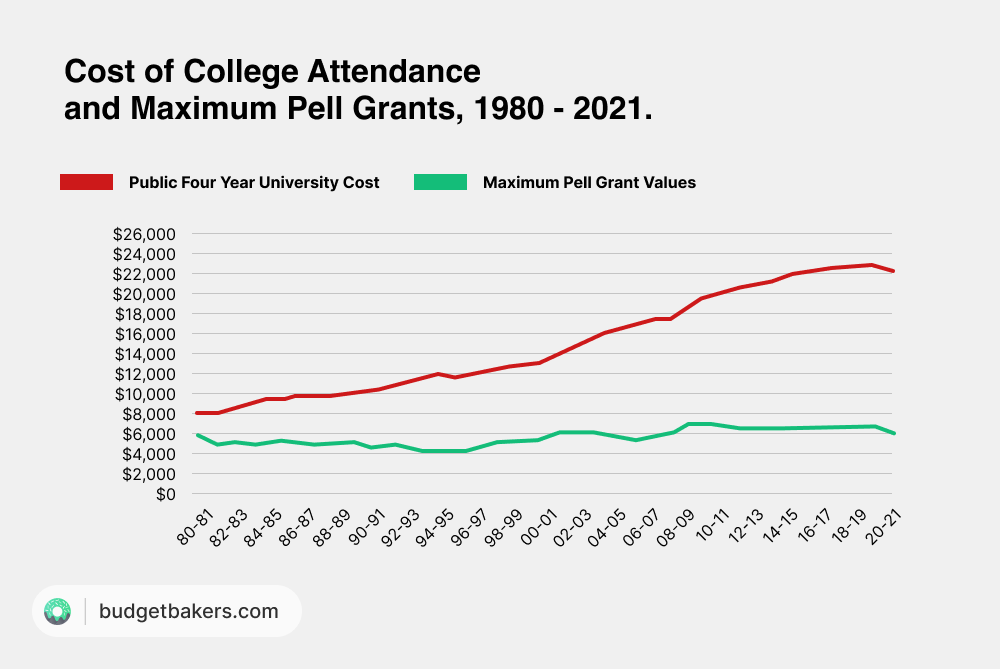

“The burden is so heavy that even if you graduate, you may not have access to the middle-class life that the college degree once provided.” This statement is from President Joe Biden on August 25, 2022, the day of the release of one of the most important bills of his term: the Student Debt Relief Plan. A long-awaited bill that offers partial forgiveness of exorbitant loan debt that has skyrocketed for decades. It’s a response to the longstanding failure to increase state support through Pell Grants.

Students in the U.S. leave college or university with a large amount of debt. For bachelor’s degree holders, debt of at least $25,000 is typical. Those who go on to earn a higher degree often have tens of thousands of dollars more in debt.

To understand the magnitude of this nationwide problem, two numbers suffice: 45 million Americans have student debt with the federal government, totaling $1.6 trillion. That’s about 1/10 of the income all Americans earn in a year. So to pay back that amount, we would have to sacrifice 10% of all citizens’ income for an entire year.

Since this isn’t an option, the government has opted for a debt relief plan to finally address the American student debt crisis. The White House claims that nearly 43 million would benefit from student loan forgiveness; roughly 20 million will have their balances canceled entirely.

In addition to keeping his campaign promise (and the upcoming midterm elections, which he hopes will attract young voters in particular), Biden justifies his debt forgiveness on two grounds. He wants to relieve college graduates of the burden of currently skyrocketing prices and give them the freedom to make investments.

“All this means people can finally crawl out from under that mountain of debt, to get on top of their rent and utilities, to finally think about buying a home or starting a family or starting a business,” Biden said. “When this happens, the whole economy is better off.”

How Much Debt Relief Are You Entitled To?

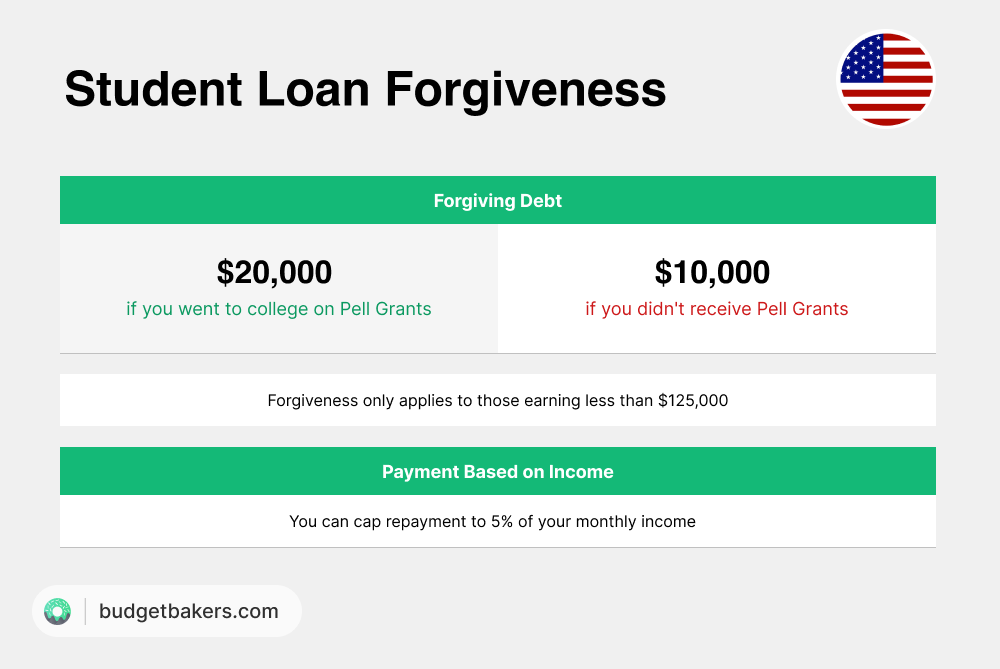

So here it is, the new Loan Debt Forgiveness Plan from the Biden-Harris administration. The idea is to forgive or reduce the debts of current debt repayers.

But not all students receive the same forgiveness. On the contrary, the amount depends on your income, and whether or not you received Federal Pell Grants while in college.

To illustrate how the student debt relief plan works and how much forgiveness you are personally entitled to, let’s take a look at four sample students. Each of them have a different type of loan and a different income, which is why they all qualify for different forgiveness – or no forgiveness at all.

The Low-Income Graduate

Let’s imagine a college graduate who earned a bachelor’s degree in 2020. During her four years of study at a public school, she accumulated $24,000 in debt. This puts her in line with the U.S. average. Among borrowers with outstanding student debt, the median debt amount in 2021 was between $20,000 and $24,999.

Now, two years after earning her degree, the young graduate is still paying off her student loan debt. Under the new Student Debt Forgiveness Plan, however, she doesn’t have to pay back the entire amount. We’ll explain why.

With a gross income of $96,000 a year, she falls into the “low-income” category, earning no more than $125,000 a year. In addition, the receipt of federal Pell Grants plays a role in the calculation of her debt forgiveness. During her studies, she received $3,980 in financial aid from the state – money she doesn’t have to pay back. Nevertheless, the money has a positive impact on her current debt.

That’s because under the new debt relief plan, the graduate will now receive $20,000 in debt forgiveness. This gives her twice the debt relief compared to students without Pell Grants. The Department of Education explains this decision by saying that grant recipients like her “typically experience more challenges repaying their debt than other borrowers.” The numbers prove it. In the academic year of 2020-21, around 30% of all students that enrolled in undergraduate programs in the United States were awarded Pell grants and nearly every recipient came from a family that made less than $60,000 a year.

Under Biden’s forgiveness plan, her debt is now $4,000, down from $24,000. Now it’s time to pay back this $4,000. At the current interest rate of 4.99% for undergraduate students with a 10-year loan term, that’s $42 per month. Before forgiveness, it was $254.

Debt forgiveness gives the student enormous freedom to spend her money on other things, such as a master’s degree. Freed from the financial burden, she can now seriously pursue a higher degree – something many people were reluctant to do in the past because of their loans.

| Debt to Date | Monthly Payment to Date | Debt After Student Loan Debt Forgiveness | Monthly Payment After Student Loan Debt Forgiveness |

| $24,000 | $254 | $4,000 | $42 |

The Married Graduate Couple

Let’s now take a look at another type of student: A married couple with a college degree – and student debt. Both have master’s degrees and $70,000 in graduate school debt each. For them, calculating their debt relief can be a bit more difficult.

Under the new reform, single borrowers with annual income of less than $125,000 are eligible for $10,000 in relief. So are married couples who file a joint tax return and whose combined income is less than $250,000. Income is defined as a borrower’s adjusted gross income in 2020 or 2021.

Our example couple has two different incomes. One partner earned $150,000 in 2021, the other $60,000. So together they earned less than the $250,000 allowed, but one spouse is over the individual limit of $125,000. Does this make them eligible for debt forgiveness of $10,000, in addition to the lower-income spouse?

The answer is yes, according to the White House.

However, things look different with a different income distribution. Let’s assume one spouse earns $80,000 and the other earns $180,000. Their combined income of $260,000 exceeds the $250,000 income limit. This means the couple is not entitled to debt forgiveness. But does the lower-earning spouse have the right to debt relief based on their individual income?

As of now, the answer appears to be no, tax experts say. They claim they are ineligible, unless some new rule allows the adjusted gross income to be reported separately.

So for married couples, it all depends on how much they earn TOGETHER. Thus, the individual income of a spouse is irrelevant, whether it is higher or lower than the allowed $125,000.

What does that mean for our sample couple? They both get $10,000 in debt forgiveness, which reduces their student debt from $70,000 each to $60,000 and $140,000 to $120,000, respectively. At the current interest rate of 6.54% for graduate students with a 10-year term, that’s $683 per month per person. Before forgiveness, it was $796.

While this provides some relief, the bulk of the debt remains. However, borrowers now have the opportunity to take advantage of a new cap that allows them to pay off their debt at 5% of their monthly income.

This doesn’t help our example couple at first glance, since 5% of their combined income is $875 per month, $200 more than they would have to pay without a cap. However, if only the spouse with an annual income of $60,000, or a monthly income of $5,000, were considered, they would only have to pay $250 instead of $683 per month.

| Debt to Date | Monthly Payment to Date | Debt After Student Loan Debt Forgiveness | Monthly Payment After Student Loan Debt Forgiveness | Monthly Payment with 5% Cap for the Lower-Income Spouse |

| $140,000 / $70,000 | $796 / $1,592 | $140,000 / $120,000 | $683 / $1,366 | $250 |

The Dropout Without a Degree

Roughly 39 million students never finish college. But what they have in common with graduates is they also take out loans during their studies, which they have to pay back. We want to take a closer look at this case.

Let’s imagine a undergraduate student who went to college from 2018 to 2020, but dropped out due to personal reasons. During his college years, he accumulated $13,000 in student debt. Is he entitled to debt cancellation?

Under the new plan, each former student is eligible for $10,000 in debt forgiveness, or $20,000 if receiving Pell Grants. Regardless of whether they graduated or not. This covers most or all balances of borrowers without a degree, who on average owe $15,000.

This is also true for our example student. Of his $13,000 debt, $3,000 remains. At an interest rate of 4.99 % for undergraduate students with a 10-year term, that’s $32 per month. Before forgiveness, it was $138.

For dropouts, receiving $10,000 not only means greater financial freedom, but possibly a path back to college. That’s because many former students drop out because they can no longer afford it. They typically then work low-paying jobs for years or even decades to repay their debt. Those who want to continue their studies now have the opportunity to do so thanks to loan forgiveness.

| Debt to Date | Monthly Payment to Date | Debt After Student Loan Debt Forgiveness | Monthly Payment After Student Loan Debt Forgiveness |

| $13,000 | $138 | $3,000 | $32 |

The Private Loan Borrower

Just as there are public and private universities, there are federal and private student loans. Both can be obtained at public and private universities.

Federal student loans are made and funded directly by the federal government. Private student loans, also referred to as non-federal or alternative loans, are made and funded by private lenders, such as banks and online lenders. And both must be repaid. But does it make a difference whether you have a government loan or a private loan when it comes to the recently announced cancellation of student loans?

For the last time, we’re introducing an example student. Let’s imagine a student who took out a private loan at a public school in addition to her federal loan. So do many borrowers who have exhausted their options for federal student loans and still need money to cover funding gaps in their education.

The young graduate racked up over $80,000 in federal debt and $12,000 in private debt over the course of her 7 years in college. After graduation, she started a job making $133,000 a year.

Now she’s paying off her debt wondering how much relief she’ll get under Biden’s new plan. While there still are some questions, there’s one thing we know for sure: The Biden-Harris administration is not canceling private student loans.

Thus, the young woman is not entitled to any debt relief. Her income exceeds the limit of $125,000 and private debts won’t be canceled. This leaves her with a $92,000 mountain of debt until there may be a new plan in the future to eliminate private student debt.

| Debt to Date | Remaining Debt After Student Loan Debt Plan | Monthly Payment |

| $92,000 | $92,000 | $1,047 |

The Bottom Line

Student Loan Forgiveness is a long-overdue debt relief initiative that will finally give students partial relief from their financial burdens. Millions of former students will receive up to $20,000 in forgiveness, enabling them to use their hard-earned income to support themselves and their families, buy a home or start a business.

Although praised for its targeting of low-income and middle-class individuals, the bill’s critics say that some who bitterly need loan forgiveness won’t benefit from it, or not enough to relieve them from their enormous financial distress.

Moreover, the additional money that graduates now have at their free disposal is reigniting the inflation debate. Economists from both political camps are critical of the student loan rebate because the additional purchasing power it creates could fuel inflation due to larger consumer spending. However, according to many experts, increased consumer spending will increase inflation by only a few base points – they estimate a 0.1%, or one-tenth of one percent, increase in inflation.

You want to know more about inflation and its effects? Read our article on what inflation is, what causes it and what you can do about it.