Written and fact-checked by business journalist

Leonie Bauer

Inflation is slowing – but prices for energy, especially natural gas and crude oil, are still at record levels in early 2023.

Many economists agree that most of the increase that we have seen in energy prices can be attributed to simple supply and demand. The world is highly dependent on fossil gas to meet its energy needs, but there is hardly enough available.

There are several reasons for this shortage, such as the war in Ukraine, the aftermath of the COVID-19 pandemic, and the uncertain future supply from renewable energy sources.

Economists at BudgetBakers took a closer look at global energy prices over a longer period of time and identified explanations as to why we, as consumers, will continue to suffer from “energy inflation” in 2023.

What Determines Global Energy Prices?

Global energy prices are driven by a variety of factors, including the cost of production, the availability of supply, demand for energy, and market conditions.

Let’s start with one of the main drivers of global energy prices: the cost of production. The expenses involved in extracting, transporting, and refining energy sources such as oil, natural gas, and coal can vary significantly depending on a number of factors, including the location of the energy source, the technology and equipment required to extract and process it, and the labor and other resources needed. These costs can have a significant impact on the price of energy on a global scale.

Supply availability is another important factor that can influence global energy prices. If the supply of a particular energy source is limited, the price may be higher due to increased demand.

This is exactly what we’ve been experiencing for the past year in terms of gas prices. Due to the immense shortage of natural gas from Russia, driven by the Russian war in Ukraine and subsequent sanctions and boycotts, gas prices have soared around the world, especially in Europe.

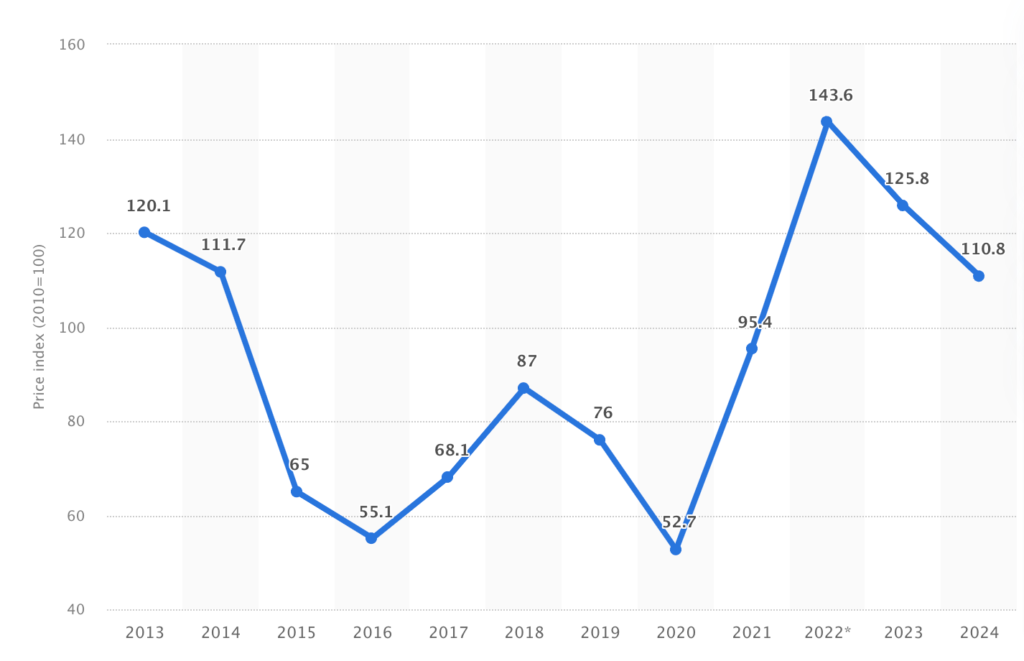

The global energy price index stood at around 95.4 in 2021. This was an increase compared to the previous year and a result of greater fuel and power demand as economies recovered from the coronavirus pandemic. For 2022, the price index reached 143.6 as the Russia-Ukraine war started to impact fuel and natural gas supplies.

Demand for energy is also an important factor in determining global energy prices. If there’s a high demand for a particular energy source, the price may be higher due to the increased competition for it. Conversely, if there is a low demand for an energy source, the price may be lower.

Finally, market conditions, such as the overall state of the global economy and the level of competition in the energy industry, can also impact global energy prices. For example, if there’s a recession (as we’re likely to experience in 2023), and demand for energy is lower than usual, energy prices may be lower. On the other hand, if the global economy is strong and demand for energy is high, energy prices may be higher.

Energy Prices in the EU

Energy prices in the European Union (EU) can vary depending on a number of factors, including the type of energy, the country, and the policies of the EU and individual member states.

In general, energy prices in the EU are relatively high compared to other parts of the world. This can be due to a number of factors, including the high cost of producing and distributing energy in Europe, as well as the various taxes and subsidies that apply to different types of energy.

Most energy needs (about 60%) are met through imports. Together, imports of oil, gas and solid fuels made up about 15 % of total extra-EU imports in 2021 (% of trade in value). This grew substantially in 2022 (to about 25% in the third quarter) as the energy crisis drove up prices on global markets.

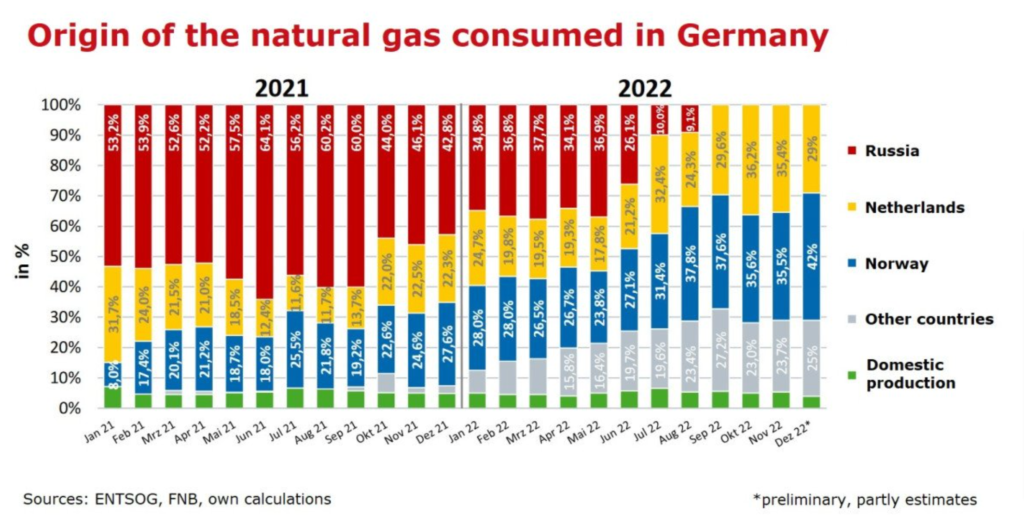

What energy crisis? Since the Russian invasion of Ukraine in February 2022, energy prices in Europe have skyrocketed. Particularly significant was the increase in natural gas prices. European countries began reducing their natural gas imports from Russia in June 2022, and have since largely cut off gas supplies from Russia. You can see this clearly in the chart below, which shows the German boycott of Russian natural gas since September 2022.

Since then, the largest economy in the EU has been importing gas mostly from Norway and the Netherlands. Only a very small proportion comes from domestic production.

However, it’s important to note that energy prices can vary significantly within the EU. For example, prices may be higher in some countries due to the cost of imported energy, while in others they may be lower due to access to domestic energy sources. These differences become clear when looking at the cost of energy in the United States.

Energy Prices in the United States

Energy prices in the United States can vary significantly depending on the type of energy being used, the region of the country, and a variety of other factors.

In general, energy prices in the United States are relatively low compared to other parts of the world. This is due in part to the abundance of domestic energy resources, such as oil, natural gas, and coal, as well as the low cost of production in the United States.

However, there are also a number of factors that can affect energy prices in the United States. For example, the cost of transportation and distribution can play a role in the final price of energy, as can taxes and subsidies.

In addition, the demand for energy can affect its price. During times of high demand, energy prices may be higher, while during times of low demand, prices may be lower.

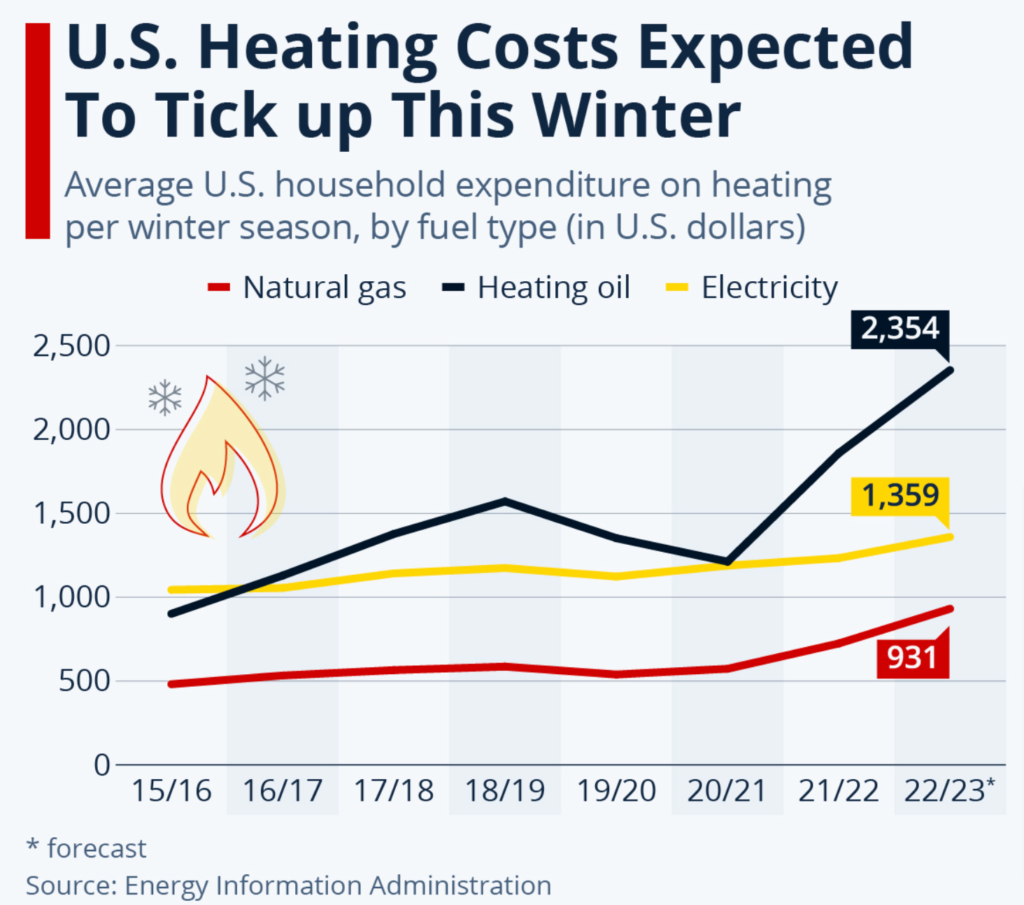

US consumers will face significantly higher heating costs in 2023 due to colder-than-average weather and high energy prices, according to the Energy Information Administration. Households that heat with oil or gas will experience a cost increase of 27% and 28%, respectively, compared to 2021/2022.

Higher forecast energy expenditures are the result of higher fuel prices. As the invasion of Ukraine and embargoes against Russian energy products have caused turmoil on global markets, oil price fluctuations are being more immediately passed on to consumers, for example through gasoline or heating oil prices rising quickly.

Previously, heating oil consumers had experienced a sharp drop in prices due to the global decline in oil demand caused by the Covid 19 pandemic. For gas and electricity, longer-running wholesale contracts are delaying the price swings that are hitting U.S. consumers full force, even as rapidly rising prices on the spot market (where utilities can buy energy on short notice) have also pushed prices higher.

Energy Prices in Asia

Energy prices in Asia can vary significantly depending on the country and the type of energy being used. In general, energy prices in Asia tend to be lower than in other parts of the world, due in part to the availability of cheap labor and resources in many Asian countries.

However, there are also a number of factors that can affect energy prices in Asia, including the cost of production, infrastructure, taxes and subsidies, and market speculation.

In some countries in Asia, energy prices may be influenced by government policies and subsidies aimed at promoting the use of certain types of energy. For example, some countries may offer subsidies to encourage the use of renewable energy sources, while others may impose taxes on fossil fuels in order to reduce their use.

It is also important to note that energy prices can vary significantly within Asia. For example, some countries may have access to domestic energy sources that are relatively cheap to produce, while others may have to import energy from other countries, which can increase the cost.

While the war in Ukraine has forced up prices of fuel such as oil and gas globally, it hasn’t hurt Asia’s energy generation. As Europe struggles with a potential power shortage, Asia-Pacific’s power supply remains secure mainly because it uses a lot of coal, data has shown.

In Asia, instead of using gas, countries are using coal because coal is domestic and less expensive. The share of coal in power generation for Asia-Pacific markets is more than 60%. Asian countries only form 11% of their power mix and imported liquid natural gas (LNG) forms a small part of that with most gas coming from domestic production.

5 Reasons for High Energy Prices

In a nutshell, there are a number of factors that can contribute to high energy prices. Some of the most common factors include:

Supply and demand

Energy prices tend to be higher when demand is high and supply is limited. This can be caused by factors such as increased economic activity, extreme weather events, or political instability in major energy-producing regions.

Infrastructure

The cost of transporting and distributing energy can affect its price. For example, building new pipelines or upgrading existing infrastructure can increase the cost of energy.

Taxes and subsidies

Governments can affect energy prices through taxes and subsidies. For example, if a government imposes a tax on fossil fuels, the price of energy may increase. Similarly, if a government provides subsidies to renewable energy sources, the price of those sources may be lower.

Production costs

The cost of producing energy can also affect its price. For example, the cost of extracting and refining fossil fuels can vary based on factors such as the type of fuel and the location of the resource.

Market speculation

In some cases, energy prices may be influenced by speculation in financial markets. For example, investors may buy and sell energy futures, which can affect the price of energy in the short term.